1. Purpose & Scope

The purpose of the Grant Accrual Estimation Guidance is outlining the requirement for each Accountable Entity (AE) to provide a reasonable estimate of accrued expenses, or payments owed for goods, services, or work provided during the quarter, on a quarterly basis for incorporation into the Millennium Challenge Corporation’s (MCC) financial statements. This enables MCC to fairly represent its assets and liabilities and to comply with federal reporting regulations and generally accepted accounting principles (GAAP).The guidance below is limited to activities managed by an AE and does not apply to MCC managed activities.

The grant accrual estimate is prepared on a quarterly basis only for signed Compact and Threshold Program funded activities that are not included in the advances and retentions data call.

2. Relevant Documents

- Grant Accrual Estimation Template. The grant accrual estimation template summarizes anticipated contract payments for goods, services, or works provided during the quarter but not yet paid. It comprises sections for 1) in house invoices and 2) work completed but not yet invoiced, or billed, as of the end of the quarter.

- Supporting Documentation provided by AE. As necessary, FMD may request supporting documentation for amounts provided in the grant accrual estimate, to include Interim Payment Certificates (IPC), invoices, contracts, etc.

3. Key Definitions

| Term | Definition |

| Accrual | The accrual is a snapshot at a point of time of the estimated liability as of the quarter end for work completed but not yet billed or invoiced. |

| Advance | The part of a contractually due sum that is paid in advance for goods or services, while the balance included in the invoice will only follow the delivery. |

| Grant Accrual | Represents the carrying value of obligations assumed for works, goods, and services performed/rendered/delivered but not yet invoiced or paid by the end of the quarter. |

| In house Invoices | Valid invoices that have been received by the AE for specific amounts owed to vendors but not yet paid by the Common Payment System (CPS) cut-off. If unpaid at the end of a period, these invoices are used to determine what payments will be made in future periods. The CPS cutoff day is 5 business days prior to the end of the month and AE’s are provided with a schedule at the beginning of the year of these dates. (Note invoices on hand but are not valid should be treated as an accrual) |

| Period of Performance | The contractually stipulated span of time during which work is completed/services are rendered/equipment is delivered. |

| Questioned Cost | Refers to a cost that is questioned for one or more of the following reasons:

|

| Retention Liability | Represents a percentage of invoice amounts retained by the AE as a guarantee for completion of works contractually agreed upon. |

4. Assumptions and Exceptions

Assumptions.

MCC grantees operate on a modified cash basis of accounting. MCC’s global portfolio of grants for Compacts and Threshold Programs is comprised of various projects and activities at:-

- various stages of implementation,

- various sectors of intervention,

- different levels of complexity,

- in countries with varying level of implementation capacities

The grant accrual estimate is comprised of two sections: 1) in house invoices; and 2) work completed but not yet invoiced, or billed, as the end of the quarter. The first section of the grant accrual estimate, in house invoices, is based on actual invoices already in possession by the AE. The second section is an estimate prepared by the Engineers or Project Directors based on expenses incurred for existing contracts as of the end of the reporting period.

MCC will conduct a quarterly review of the degree of variance between past estimates and actual disbursements.

MCC reviews annually ongoing AE audits and determines if any of the significant findings reported in past program audits affect the grant accrual.

Exceptions

An accrual amount is not recorded for any Compact or Threshold Program that has closed and is past the closure date per the Compact or Threshold Program agreement and MCC guidelines.5. Acceptable Methodologies for Determining the Accrual

While there may be additional situations that result in the recognition of liabilities, accruals must generally be recognized in the accounting period in which:- the title to goods is accepted;

- services are rendered; or

- progress is made in contract performance.

NOTE: MCC prepares its financial statements in accordance with US GAAP.

For facilities constructed or equipment manufactured by contractors or grantees according to agreements or contract specifications, amounts recorded as payable must be based on an estimate of work completed under the contract or the agreement.

Accruals should be based on the best available information on expenditures for an activity. Base the accruals for expenditures on an analysis of the projected expenditure rate or actual expenditures, when feasible. Use estimates where documentation is not available. Where estimating techniques are used, every effort should be made to ensure that reasonable estimates are recorded.

In determining the accrual, the preparer at the AE may utilize a variety of techniques dependent on the nature of the contract such as:

- Receiving reports showing quantities received and determining whether a given shipment is complete or partial are useful in determining the amount of the accrual when the invoice has not been received.

- A prior actual accrual or a trend of several previous periods may be appropriate when estimating a current accrual.

- Quarterly performance reports from grantees should be used to accrue expenditures for grants.

- Estimates should be obtained from project managers or other operating officials who are familiar with progress under the contract or grant if reports from contractors or grantees are not available or are not feasible.

- Contractual Services. Accruals should be based on progress reports and/or certificates of performance to ensure that services have been rendered in accordance with the contract provisions. Certificates of performance are generally accompanied by a billing from the contractor. Burn-rates and/or the contract clauses themselves may also be used when needed to generate the accruals.

- Distribute the entire total estimated cost evenly over the entire period of the performance on a quarterly basis;

- Distribute a fixed percentage of the total estimated cost on a quarterly basis over the period of performance; and

- Distribute a fixed dollar amount quarterly over the period of performance.

- Reviewing implementation letters signed prior to the Compact or Threshold Program End Date that may provide for the reimbursement of the country’s Government for a prior contribution and accruing a liability where appropriate.

- Reviewing those open contracts where deliverables are submitted prior to or on a Compact End Date, however have not yet been billed or paid during the period between the Compact End Date and the Compact Closure Date to establish the appropriate accrual to be made at the end of the quarter.

6. Accounting for Advances

Where an invoice for an advance is received but not yet paid this should be reported as an In House invoice with an annotation that it is for an advance.7. Responsibilities

- Financial Management Division (FMD). FMD sends the grant accrual estimation template on a quarterly basis and consolidates the AE responses to determine the total accrual value.

- Accountable Entity (AE). The AE establishes a documented control mechanism to verify that the grant accrual estimate reported to MCC agrees with the supporting documents used in the relevant sections of the grant accrual calculation. The individual responsibilities of the Fiscal Agent and the Director of Administration and Finance (or equivalent thereof) are set out in the Fiscal Accountability Plans for each AE. The AE prepares and transmits the grant accrual estimation to FMD.

- Program Financial Services (PFS) Lead. The PFS Lead provides oversight and guidance to the AE throughout the grant accrual estimation process.

8. Procedures

- Grant Accrual Estimation Transmittal

- Template Distribution. In the final week of the quarter, FMD sends the grant accrual estimation Excel template to each AE and PFS Lead via email, along with a set of instructions for filling out the template.

- Complete the Grant Accrual Estimation Template

- Purpose of Estimation. The AE must use the template to capture anticipated contract payments for goods, services, or works provided during the quarter but not yet paid.

- Exchange Rate. For in house invoices and grant accrual estimates denominated in currencies other than US dollars these should be converted using the exchange rate at the end of the quarter and applied consistently[[The exchange rate source should be consistent with the guidance contained in the FAP.]].

- These anticipated payments are broken out into two sections:

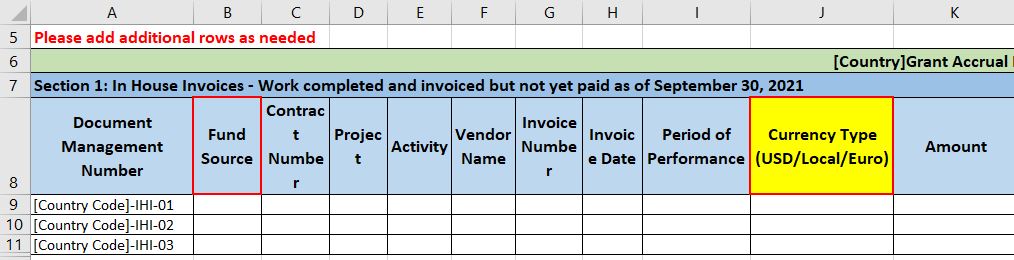

- Section 1: In House Invoices. The AE must identify the invoices that have been received but not yet paid and add them to section 1 of the template.For the purposes of the accrual In House Invoices are defined as both:

- Invoices received within the accounting system but not paid.

- Invoices physically on hand but not entered into the accounting system where the period of performance is prior to the accrual date.Note: Please be sure to review the Interior Business Center (IBC) payment processing cut-off dates.

-

- Manually update the country name in the first row.

- Update the Document Management Numbers in Column “A”. Please add additional rows if applicable.

- Select “CDF”, “CFF”, “COM”, or “THP” in the drop-down menu in Column “B” to indicate the funding source used for the invoice.

- Manually enter the requested data in columns “C” through “I” for each invoice row.

- Select “USD”, “Local”, or “Euro”[[The exchange rate used should reference the functional currency of the contract.]] in the drop-down menu in Column “J” to indicate the currency used in the invoice.

- The amount in Column “K” should be the invoice Gross Amount.

- Enter the exchange rate at the end of the quarter in Column “R”, row 2 or 4.

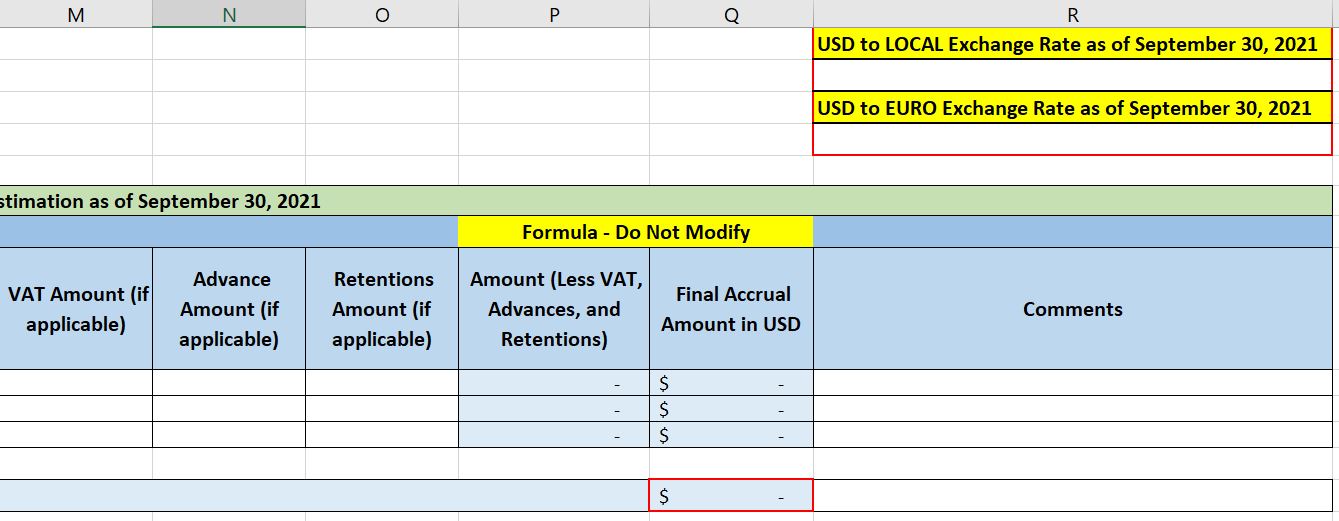

- If applicable, manually enter any VAT amounts, or advances or retentions amounts in columns “M” through “O” for each invoice row. This will ensure that VAT amounts, advances, and retentions are not captured in the estimation. Please note that columns “P” and “Q” are formula driven and should not be modified by the AE.

- Ensure that the Section 1 total formula in column “Q” captures all lines and accurately reflects the total amount of in-house invoices.

-

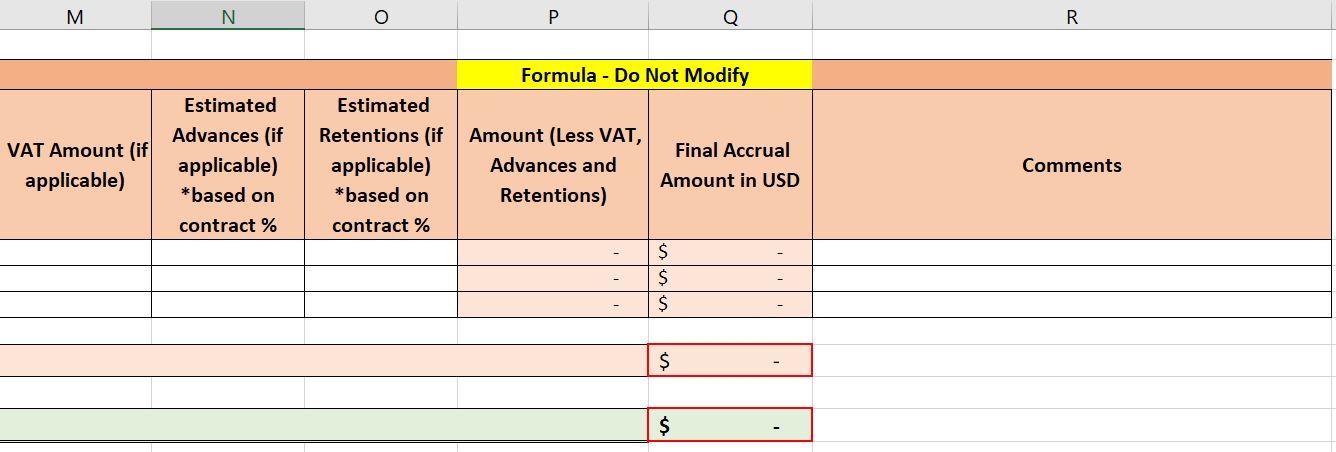

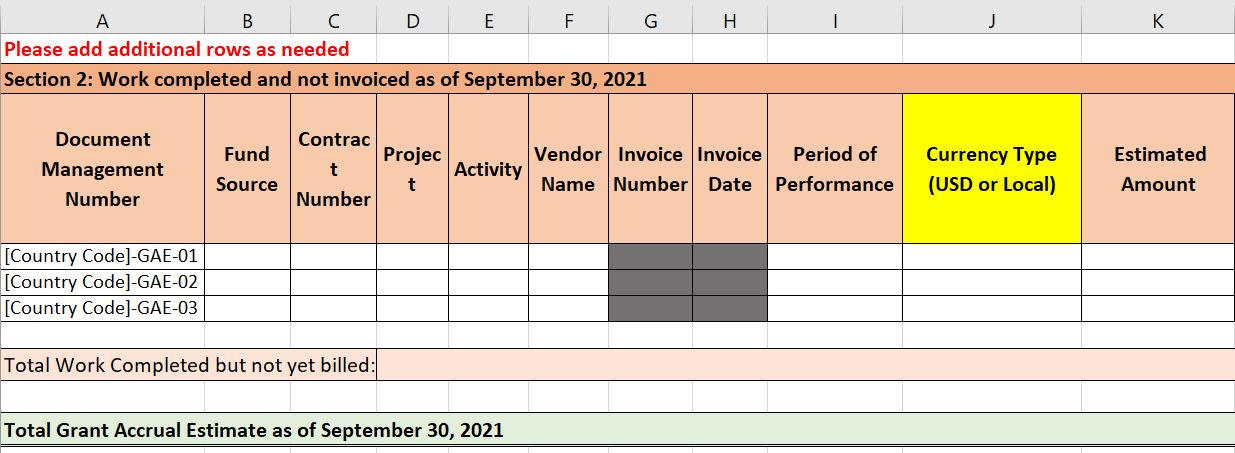

- Section 2: Works Completed but Not Invoiced as of Quarter-End. The AE must estimate the value of goods, services, or works provided during the quarter but not yet invoiced. Please work with contractors and vendors to determine appropriate estimations for each contract identified.

- Update the Document Management Numbers in column A. Please add additional rows if necessary. Manually enter the requested data in columns “B” through “K”, with the exception of Invoice Number and Invoice Date.

- If applicable, manually enter estimated value added tax (VAT) in column “M”, as well as any estimated advances or retentions (based on contract percentage), in columns “N” and “O”.

- Please note that columns “P” and “Q” are formula driven and should not be modified by the AE. Please utilize the Comments column as necessary.

- Ensure that the Section 2 total formula in column “Q” captures all lines and accurately reflects the total estimated amount of goods, services, or works provided during the quarter but not yet invoiced.

- Ensure that the total formula does in fact capture the sub-totals from both Section 1 and Section 2.

- Ensure that the amounts captured in the relevant sections of the data template agrees with the supporting documents used to complete the Sections 1 and 2.

- For each item in section 1 [In House Invoices], the reported amount must match the amount on the related physical invoices.

- For each item noted in Section 2 [Works Completed but Not Invoiced as of Quarter End], the amount will be an estimate and must match the supporting documents provided by the Project Lead and/or Engineer.

- Section 1: In House Invoices. The AE must identify the invoices that have been received but not yet paid and add them to section 1 of the template.For the purposes of the accrual In House Invoices are defined as both:

General Instructions

- Advances and/or retentions activity must be manually entered in both Section 1 and 2 in order to ensure they are properly subtracted from the estimate total. Advances and retentions must be captured only in the advances and retentions data call; please see AE Advances and Retentions Data Call Guidance.

- Do not include invoices to be paid via the permitted account and to be reported as a 2a on the MCDR as either an In House invoice or accrual estimate.

- Should the AE administer sub-grants, guidance should be sought directly from MCC’s FMD to determine if there should be an accrual or allowance recorded to account for potential questioned costs this will be based on historical questioned cost trends, if applicable.

- The accrual estimate will be validated on a continual basis subsequent to the period the accrual was booked to ensure a reasonable estimate is captured for each AE. In House Invoices

- Where an In-House invoice is on hand for the initial advance under an agreement but has not yet been paid – the invoice should be forwarded to MCC as part of the data call. It should be recorded on the data sheet – MCC will determine the appropriate course of action.

- Ensure that accrual estimates only include costs that will be paid with either Compact, Compact Facilitation and / or Threshold Program funds; dependent on the AE (i.e., do not include costs associated with VAT amounts and government contributions).

- Where the accrual relates to consultant costs and the contractual deliverable was accepted prior to the accrual date but not invoiced, the value attributable to the deliverable should be accrued.

- Where an accrual needs to be made for consultant costs and the deliverable has not been submitted or has not been accepted as of the accrual date, then an estimate should be made of the percentage completed, in consultation with the project manager / director as appropriate. Having determined the percentage complete this should then be used to calculate the value of the work completed as of the accrual date.

- If the AE entity is aware of work being performed under a contract and amount to be paid is contingent on data measurements not known at the end of the quarter, please forward details to MCC (mccaccruals-retentions-advances@mcc.gov) for determination of the appropriate course of action.

- The AE should develop an internal process with its Project Directors and Engineers on how to capture work completed but not yet billed or paid as of the end of the period. This process should be captured in a desktop procedure manual to ensure compliance on a quarterly basis.

- Where there is a dispute between the AE project directors or engineers and the contractor as to the percentage completed, then consistent with MCC’s accounting policy for liabilities the AE’s estimate of the minimum amount of the percentage range will be accrued.

- The AE should develop an internal process to ensure completeness of the preparation of the accrual. Specifically, the AE should review the previous quarter end grant accrual submission to identify those accruals reported that have yet to be paid and confirm that an appropriate amount is re-accrued. If it is determined that it is not appropriate to re-accrue the amount this should then be documented by the AE.

Grant Accrual Estimates

- Grant Accrual Estimation Submission.

- The completed grant accrual estimation template is due to MCC FMD before 11:59 PM Washington, DC time, on the dates listed is due 8 calendar days after quarter end, if that is a weekend, then the next business day.

- Submit all items to MCC to the following email address: mccaccruals-retentions-advances@mcc.gov