Program Overview

MCC’s $27.3 million Guatemala Threshold Program (2016–2021) funded the $3 million Guatemala Tax and Customs Activity, which aimed to increase resources by improving efficiency in customs without affecting trade facilitation. The objective of the Threshold Program was to “support Government reforms to increase the availability of resources by improving the efficiency of tax and customs administration.” The project was based on the theory that increased voluntary compliance will provide more revenue for the Government of Guatemala.

Evaluator Description

MCC commissioned Customs and Border Management Services LLC to conduct an independent final performance evaluation of the Guatemala Tax and Customs Activity. Full report results and learning: https://evidence.mcc.gov/evaluations/index.php/catalog/2292.

Key Findings

Addressing Customs Issues and Policy

- The project addressed customs issues in three of the five identified areas that contributed to a reduction in revenue leakages and mobilization of resources.

- Progress was made on five of the six policy milestones in the Threshold Program.

Achievement of Intended Outcomes

- Six of the 11 activities achieved medium to high results, with the remaining five activities achieving low or no results.

- More than half of the brokers (61 percent) and 83 percent of the Superintendencia de Administración Tributaria (SAT) employees interviewed saw positive changes in enhanced fraud detection.

Factors Contributing to or Hindering Results

- The implementer had a breadth and depth of consultant expertise that included both local and international perspectives, allowing for the implementer to resolve issues effectively at reasonable costs.

- Insufficient time of SAT personnel delayed the implementation of some activities and resulted in no SAT response on aspects of this evaluation.

Supporting Sustainability

- The focus on a few activities provided concrete examples of success, creating a template for replicable work.

- A lack of private sector involvement prevented a greater impact on the compliance of customs regulations.

Evaluation Questions

This final performance evaluation was designed to answer the following questions:

- 1

Did the project address critical issues? - 2

Were policy milestones achieved? - 3

Were intended outcomes achieved? - 4

What factors contributed to or hindered the achievement of results? - 5

What factors contributed to or hindered the sustainability of results? - 6

What can be learned from a rolling design approach and implementation? - 7

Were best international practices used?

Detailed Findings

Addressing Customs Issues and Policy

Four reports diagnosed customs issues in Guatemala between 2014 and 2015. These reports identified five areas of work: (1) refine risk management to inspect the riskiest shipments, (2) provide adequate field personnel in number and skill, (3) create working conditions that reduce incentives for corruption, (4) provide equipment to reduce delays in clearance, and (5) improve internal control mechanisms to detect and redress revenue leakages and corruption. Of these issues, the project addressed risk management, ways to correct under-valued import declarations, and a new strategy to address corruption.

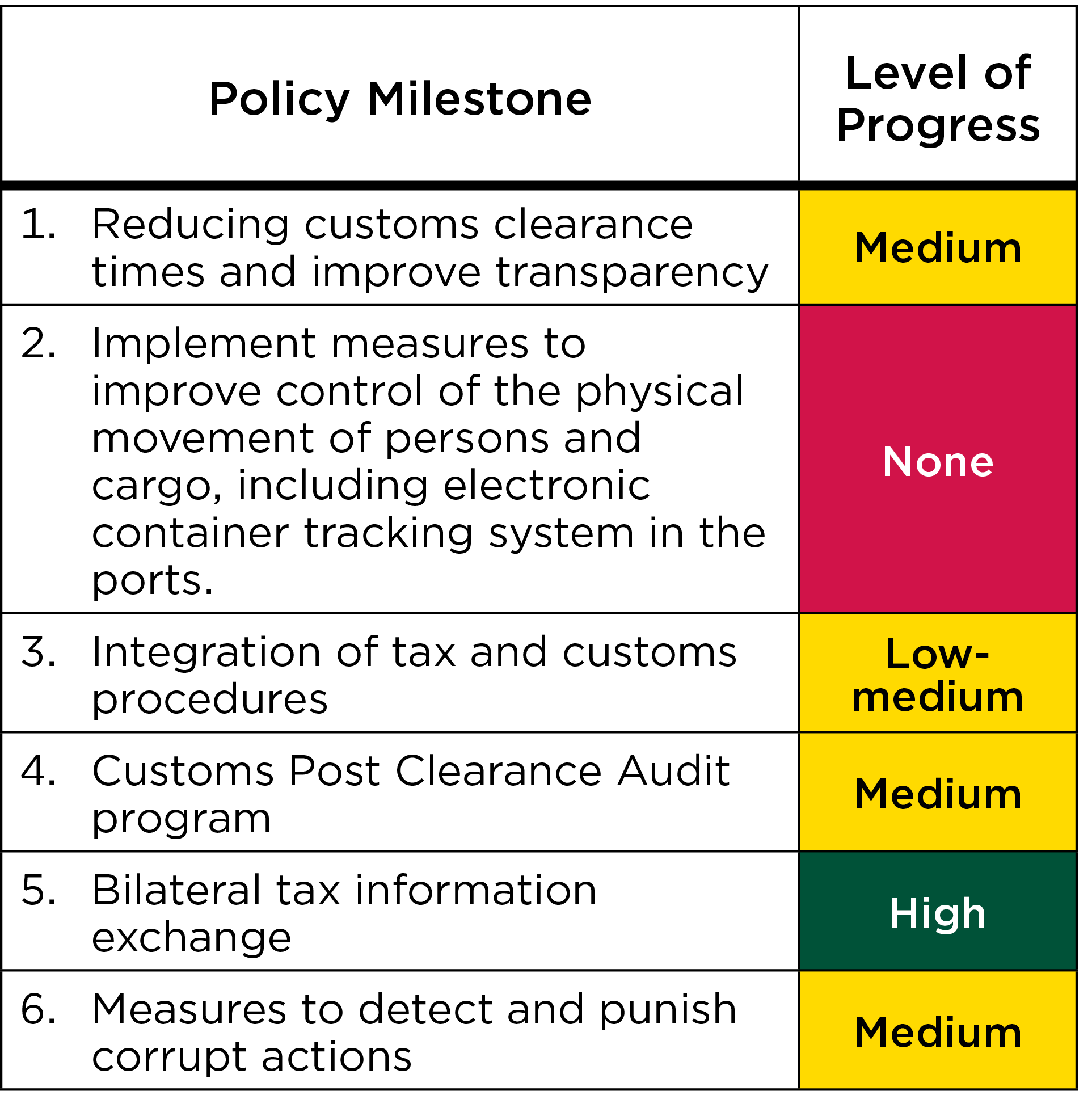

In the Threshold Program, the importance of policy milestones was noted but not required for the release of funds. Despite not being required, the project made progress on five of the six policy milestones. The table notes the level of progress for each policy milestone.

Achievement of Intended Outcomes

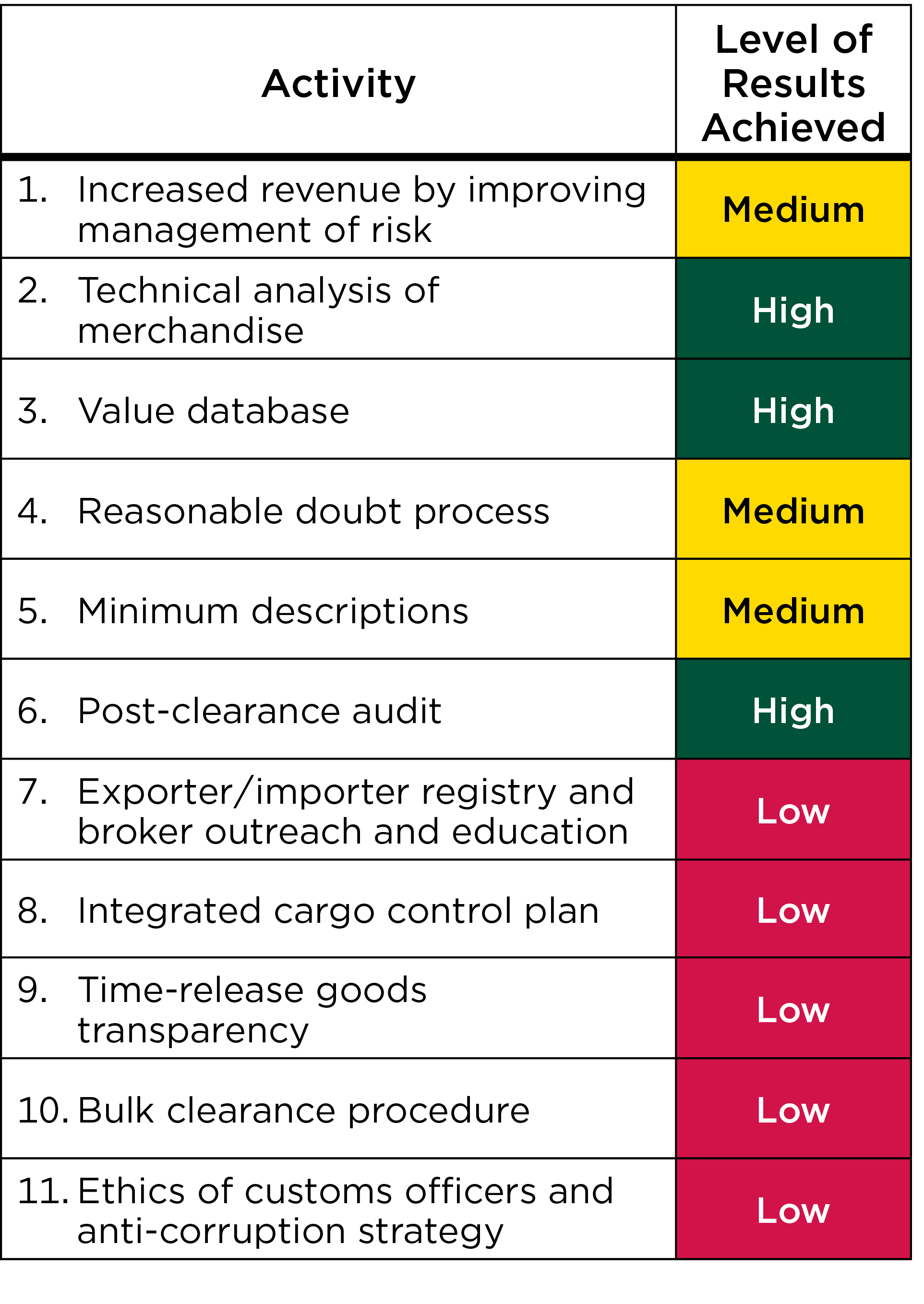

The Guatemala Tax and Customs Activity achieved varied results across the 11 activities implemented. Six of the 11 activities implemented achieved medium to high results, and the other five activities implemented achieved low to no results. Progress was made in achieving the objective of the Threshold Program, but the results achieved varied over time. In the case of medium to high results, the Threshold Program specifically mentioned instituting an effective customs post-clearance audit program. More than half of the 88 brokers (61 percent) and 83 percent of the 53 SAT employees interviewed saw positive changes in enhanced fraud detection. For the value database, the implementer reported 740 personnel were trained and informed on the value database with all new recruits trained on it. Similarly, almost half of the 88 brokers (48 percent) interviewed saw a positive change in merchandise classification, with most of the change seen at Express Aéreo at the Guatemala City Airport.

Five of the 11 activities implemented had low results because these activities were either partially implemented, or no significant progress was made. For example, the integrated cargo control plan was designed as a large comprehensive program but was only partially implemented. Part one of the activity took place successfully, with multiple training sessions strengthening customs verification and reviews. However, part two of the activity did not take place because U.S. Customs and Border Protection was unable to assist with further training or mentoring due to the Customs Merchandise Verifiers’ inability to pass a security clearance. SAT has a new anti-corruption strategy and publicity campaign at the three ports. Both brokers and SAT employees stated they saw a positive change from the new policy, but there is no data available on customs investigations showing a change.

Factors Contributing to or Hindering Results

As noted above, the Guatemala Tax and Customs Activity had mixed results. The implementer had a breadth and depth of consultant expertise that included both local and international perspectives. This allowed for the implementer to resolve issues effectively at reasonable costs. MCC’s willingness to provide no-cost extensions allowed the implementer additional time to achieve the project’s objective. However, a number of factors hindered the project in achieving results. These factors included a lack of formal incorporation into SAT’s annual work plan, leading to a lack of SAT personnel on various activities and a lack of private sector focused work. In addition, COVID-19 had an effect in slowing down work in 2020.

Supporting Sustainability

Geographic Coverage of Project

Three factors contributed to the sustainability of the results: (1) an agreement between MCC and SAT on post-implementation indicators to continue to measure results, and (2) a focus on few concrete activities using approaches that are replicable. The longer timeframe enabled not only the achievement of results, but it allowed for a pathway of continued results beyond the timeframe of the project. However, two factors hindered sustainability: (1) a lack of effective transparency and (2) a lack of involvement from the private sector. Transparency and project effectiveness were hindered by the limited circulation of technical reports. A lack of private sector involvement prevented a greater impact on compliance with customs regulations.

MCC Learning

Learning and knowledge exchanges can be very effective when they are focused on a specific problem, involve both mid- and high-level officials, and have a medium-term focus that is sufficiently long to implement new policies and procedures.

Any long-term reforms need to be integrated into the agency’s annual planning and performance assessment process.

Technical advisors need to have not only strong and relevant technical knowledge but also skills in organizational change management.

Invest to put better data systems in place from the beginning of the project to track progress, especially for outcomes that both have a strong causal impact on the project objective and are in the manageable interest of the agency benefiting from the technical assistance.

For programs with many actors and no in-country presence after program closure, MCC’s M&E staff should ensure that the evaluator has access to implementer staff and advisors that provided key assistance during the program.

Evaluation Methods

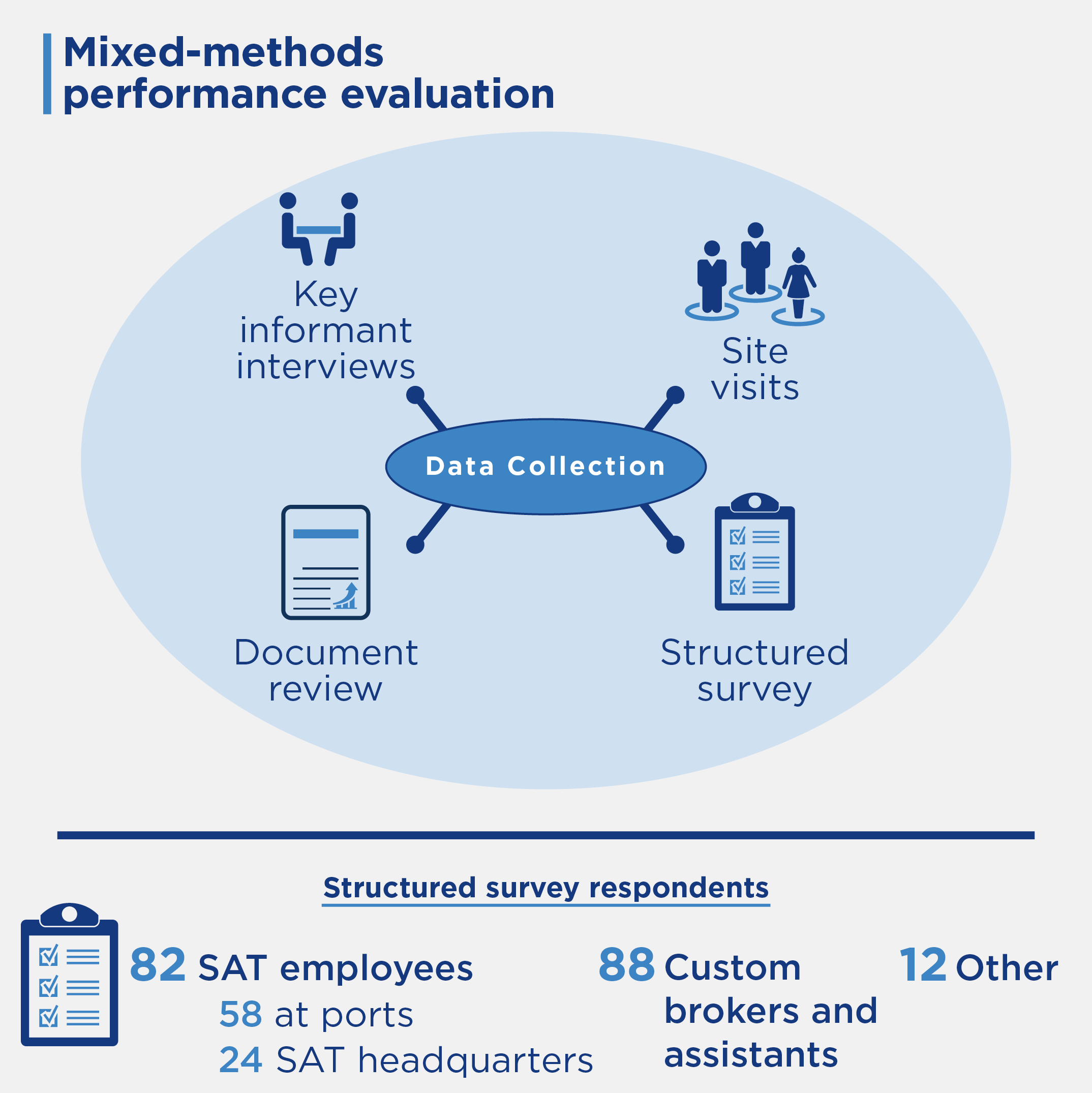

This evaluation assessed the results of the Guatemala Tax and Customs activity. The evaluation used a mixed-methods approach to obtain findings, including a document review, key informant interviews, a structured survey, and site visits. Data collection took place over three phases. The first phase took place in December 2019 with a site visit. Due to COVID-19, the second phase took place in Spring 2021, using Zoom. The third phase took place in-person in June and July 2022 with site visits. The findings are drawn from the following data sources:

- Key informant interviews with 182 respondents

- Document review of annual plans, work plans, monthly reports, and other relevant documents

- Site visits to three customs locations (Puerto Tomás, Puerto Quetzal, and Guatemala City Airport- Express Aéreo)

2023-002-2855