Program Overview

MCC’s $271 million El Salvador Investment Compact (2015–2020) aimed to improve El Salvador’s competitiveness by increasing private investment through the $41 million Investment Climate Project, comprising the El Salvador Investment Challenge (ESIC), Regulatory Improvement Activity (RIA), and Public-Private Partnerships (PPP) Activity. MCC’s $27.3 million Guatemala Threshold Program (2016–2021) aimed to catalyze private investment in infrastructure through its $1.5 million Public-Private Partnership Activity. MCC conducted one joint evaluation due to the two programs’ similar nature and geographic proximity.

Key Findings

Public-Private Partnership Support in El Salvador and Guatemala

- In El Salvador and Guatemala, key features of the PPP enabling environment—such as political support, institutional capacity, and a clear legal and institutional framework—have eroded since 2021.

- In both countries, the future of PPPs is at risk despite the approval of the first PPP projects in 2021.

El Salvador Investment Challenge

- Eight of nine public investments were completed, but only two were operational by 2023.

- ESIC accelerated private investment around its public infrastructure investments, but additional investment from firms is not expected in the long term.

Regulatory Improvement Activity in El Salvador

- Government institutions have utilized the regulatory improvement tools to assess the costs and benefits of regulations and reduced unnecessary burdens on businesses.

- The Government of El Salvador’s emphasis on streamlining construction permit regulations may have contributed to the increase in private investment. However, further support from the government for regulatory improvement is required to transform all aspects of the regulatory framework.

Evaluation Questions

This final performance evaluation was designed to answer the following questions.

- 1

Were the outputs and outcomes envisioned for the activities and sub-activities fulfilled as intended? - 2

To what extent has the Investment Climate Project in El Salvador and the Public-Private Partnership Activity in Guatemala resulted or is likely to result in greater private investment?

Detailed Findings

These findings build upon the interim evaluation report results published in 2021.

Public-Private Partnership Support in El Salvador and Guatemala

Source: PROESA records.

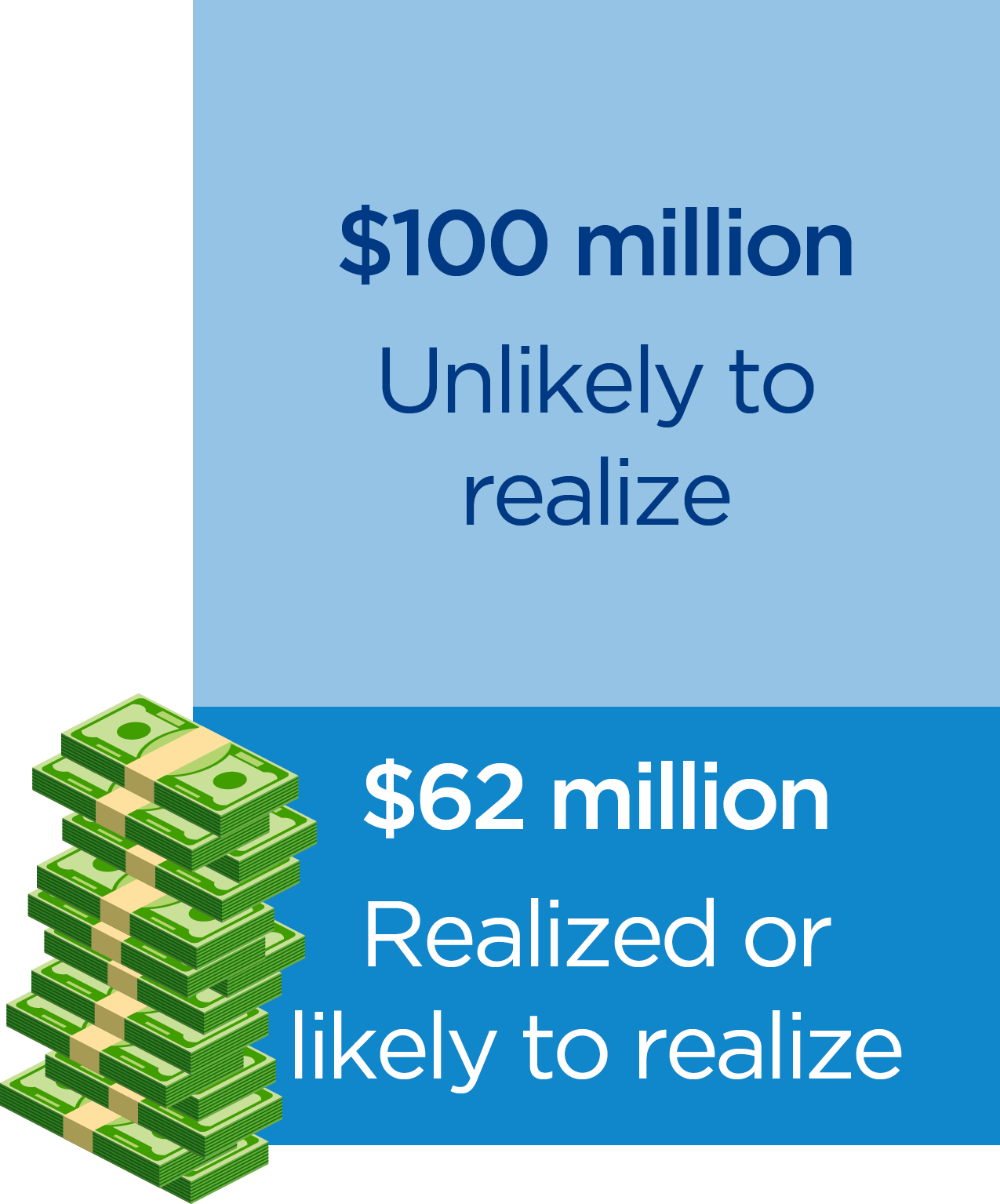

In El Salvador, the PPP to expand the cargo terminal is underway. The PPP will result in a total investment of US $62 million by completion. However, investments from the other PPP projects supported by FOMILENIO II, the Salvadoran implementing entity, are unlikely to materialize. In Guatemala, the congressional approval of the Escuintla-Puerto Quetzal Highway in 2021 was a significant development for the PPP Activity. However, the delay in beginning its operation has dampened enthusiasm for PPPs in the country.

In both countries, key features of the PPP enabling environment such as political support, institutional capacity, and a clear legal and institutional framework have eroded since 2021. PPP authorities have gradually lost capacity in structuring and managing PPPs, given the relatively limited pipeline. PPPs did not gain support from powerful political champions despite the success of the expansion of the cargo terminal project in El Salvador and the approval of the Escuintla-Puerto Quetzal Highway in Guatemala.

In both countries, PPPs are in a critical stage. Guatemala has a pipeline of robust PPP projects, but the delay and potential cancellation of the Escuintla-Puerto Quetzal Highway project represent the greatest risk in the short term. In El Salvador, the funding of key projects via traditional procurement and often taking on loans, along with the dissolution of the Export and Investment Promotion Agency (PROESA), which previously managed all PPPs, pose the biggest challenges to the future of PPPs.

El Salvador Investment Challenge

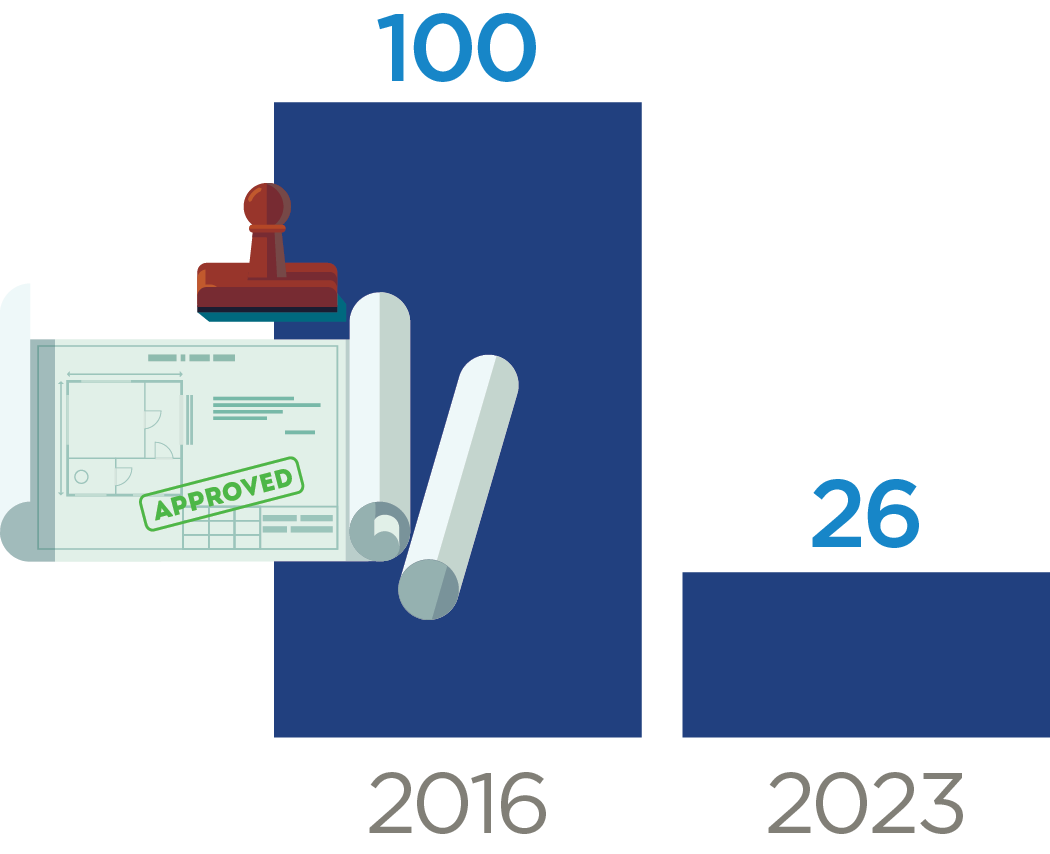

Average days to obtain a construction-related permit

Note: Days reported by a panel of firms surveyed in 2016 and 2023

Source: El Salvador enterprise surveys 2016 and 2023. World Bank.

The El Salvador Investment Challenge Sub-Activity identified and funded nine public investments, including roads, customs office improvements at the border, and water and sanitation systems. In 2023, eight of nine public investments were completed, but only two were operational: the Anguiatú border crossing and the bypass road connecting Flor Amarilla and Ateos. ESIC was an effective tool that engaged the private sector to identify public investments with high rates of return that have positive ripple effects in local communities such as increased economic activity near the ESIC-funded bypass and ancillary road.

Each public investment required a private counterpart investment that was equal to the total cost of the public good. These private investments included a hotel complex, enterprise locale expansions, and new commercial processing plants that would benefit from new roads, water systems, and other ESIC-funded public investments. ESIC had a small catalytic effect on private investment. However, economic conditions, rather than public investments, have driven private investments of ESIC firms.

Regulatory Improvement Activity in El Salvador

Regulatory Improvement Organism (Organismo de Mejora Regulatoria, or OMR) has continued implementing the regulatory improvement law, which seeks to develop clear rules, procedures, and simplified services, and continues supporting public institutions’ use of regulatory improvement tools. The adoption of the regulatory improvement tools have dissuaded institutions from creating additional regulatory burden for businesses. Similarly, the adoption of regulatory impact assessments has prompted institutions to assess whether creating additional regulations is cost-effective, which introduces a new counterweight to introducing new regulatory burden on the private sector.

El Salvador has experienced higher private investment in recent years, and regulatory improvements may have contributed to it. Since 2017, OMR played a substantive role in decreasing wait-times for construction permits. Reports from a panel of firms surveyed in 2016 and again in 2023 show a decrease of 74 days on average to obtain a construction permit.

A successful implementation of the RIA requires political and financial support from key champions to overcome resistance to change. The government prioritized regulatory improvement activities as part of the strategy aimed at improving the environment for investing and doing business in the country. The evaluation observed progress on specific issues, such as reducing wait-time for construction permits, but impacts on other regulatory burdens could not be measured.

Economic Rate of Return

MCC considers a 10 percent economic rate of return (ERR) as the threshold to proceed with investment. Neither MCC nor Mathematica calculated ERRs for the Guatemala PPP Activity because it was under a Threshold Program.

- 11.4%

Public-Private Partnership Activity - 12.9%

El Salvador Investment Challenge - 13.5%

Regulatory Improvement Activity

Mathematica estimated three distinct ERRs for the El Salvador Investment Climate Project. PPP was estimated to be 11.4 percent ESIC was 12.9 percent; and RIA was 13.5 percent, suggesting that they are cost-effective. The primary benefit stream for RIA is time savings linked to improved regulations; the primary benefit stream for the PPP Activity is increased revenues linked to enhanced cargo terminal capacity; and the primary benefit streams for ESIC are time savings at the border and in transit, increased tourism, and improved health linked to public goods. All are above MCC’s hurdle rate of 10 percent to consider projects worth pursuing.

MCC Learning

PPPs should not be forced into a project logic when they do not fit the identified problem. In El Salvador, the PPP Activity suffered from a lack of long-term support, potentially because the government did not have to invest any of its own funds. In Guatemala, the causal linkages between PPPs and the identified constraint related to education were too indirect. MCC should carefully consider the incentives and political economy of all actions needed to realize each PPP and if PPPs are the right tool in each context.

MCC should have supported stronger linkages between RIA and ESIC and the PPPs. If the OMR had used the ESIC projects as case studies, they could have had concrete examples of the obstacles that private companies face in implementing infrastructure investments due to regulatory burden. In the future, MCC should emphasize the synergies between activities under the same project and encourage better communication across MCC and MCA activity teams.

It is important to have off-ramps when implementation doesn’t go according to plan. The requirement that the Guatemalan congress needed to approve each PPP deal made it extremely difficult to execute PPPs. Ultimately, MCC decided to suspend the PPP Activity in 2019. MCC should continue to have risk mitigation plans and off-ramps in place when projects face similar challenges in the future.

Evaluation Methods

The evaluations in both El Salvador and Guatemala used mixed methods, including third-party surveys and indices, and key informant interviews and focus group discussions, to assess the programs’ implementation, results, and sustainability.

For the final report, Mathematica used data from interviews conducted in 2023 (documenting the implementation and results from mid-2021 to mid-2023), with approximately 30 individuals representing program implementers, relevant public authorities, and firms affected by MCC-funded activities.