Program Overview

MCC’s $650.1 million Morocco I Compact (2008-2013) funded the $42.8 million Financial Services Project. The project aimed to transform microcredit associations into microfinance institutions and increase operational efficiency of and access to financial services to increase microentrepreneurs’ incomes. Activities included a loan to Jaïda—a fund for microfinance institutions—as well as technical support, training, and tools for associations to transform, improve operations, diversify services offered, and expand mobile banking.

Key Findings

Transforming from Microcredit to Microfinance

- Supported associations reported new processes, strategic plans, and improved risk management, but none transformed from microcredit to microfinance institutions by program end.

Funding, Operational Efficiency, and Transparency

- Jaïda supported 11 microcredit associations, with large microcredit associations absorbing most of the funding.

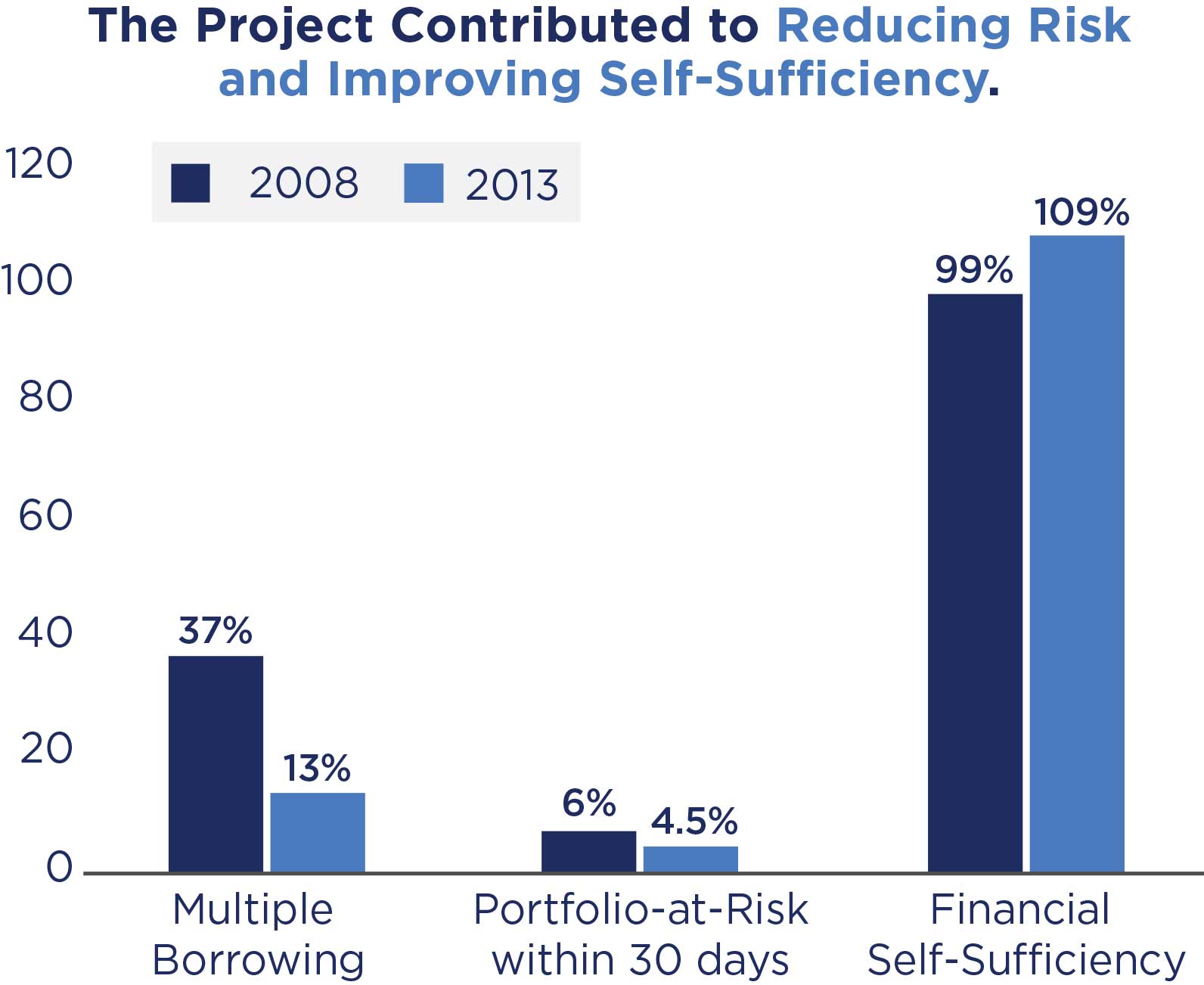

- Though not solely attributable to the project, the sector improved from 2008 to 2013, with reduced multiple borrowing, reduced Portfolio-At-Risk within 30 days, and increased financial self-sufficiency ratio.

Social and Environmental Standards

- Over 2,300 credit agents and agency managers were trained in environmental and social protection practices, though knowledge and implementation of these practices remained a challenge for credit agents and microentrepreneurs.

Access to Microfinance Products and Services

- 51,000 microenterprises received loans through Jaïda -supported microcredit associations.

- 50 of the 150 mobile banking agencies were operational by June 2013, resulting in less than 3.5 million USD in loans granted through mobile branches (9 percent of target).

Income and Sustainability

- A sample of 48 new mobile banking clients who received loans in March-April 2013 reported annual household income increased, though the evaluator did not attribute high confidence to this estimate.

- The short duration of the evaluation period limited its ability to assess income impacts and the sustainability of results.

Evaluation Questions

The performance evaluation was designed to assess whether providing loan support, training, and equipment for microfinance associations led to desired outcomes. Did they:

- 1

Transform microcredit associations into microfinance institutions? - 2

Improve funding, operational efficiency, and transparency of associations? - 3

Improve social and environmental standards of associations and microenterprises? - 4

Increase access to financial services for microenterprises? - 5

Reduce cost of financial services to microenterprises? - 6

Increase household incomes of microentrepreneurs?

This evaluation was implemented in June-September 2013 before the compact closed and as Morocco was coming out of a financial crisis. Therefore, interpretation of results also considers how the project supported navigation through the financial crisis, rather than only considering whether or not the expected results defined pre-crisis were achieved.

Detailed Findings

Transforming from Microcredit to Microfinance

The project complemented reforms underway by the Central Bank—Bank Al Maghrib (BAM)—for microcredit associations to transform into microfinance institutions offering all financial products and services allowed by the banking law, as well as efforts by BAM to reduce multiple borrowing through the Central Risk Division and centralized data systems. Thirty-one grants across five microcredit associations supported this effort. The project also supported small microcredit associations through the Réseau de la Microfinance Solidaire to coordinate resource sharing.

Funding, Operational Efficiency, and Transparency

A $30 million subordinated loan plus an additional $3 million in repaid interest was provided to Jaïda, a Moroccan microfinance funder launched in 2007 that was well-positioned to support microcredit associations excluded from the formal financial sector. Large and medium microcredit associations found the Jaïda terms acceptable, but small associations found the required procedures for portfolio quality and financial structure too strict. Technical support to improve operational efficiency and transparency focused on improving microcredit associations’ management information systems for improved data management and reporting to the Central Risk Division. The Jaïda loan was to be paid off by September 2017 if all other primary loans were paid off and there was money left.

Social and Environmental Standards

A loan officer processes a microfinance loan at a mobile bank in the town of Ouaouizeght, in Azilal Province, Morocco.

The loan agreement between the project and Jaïda required all microcredit associations and microenterprises financed by the loan to ensure their activities did not endanger environmental and social health. However, the environmental and social regulations training did not support credit agents and microentrepreneurs to put the knowledge into practice: Agents reported the content was too dense for a one-day training with no practical exercises or resources to support implementation post-training. As a result, 45 percent of the interviewed credit agents reported they did not educate their clients on the concepts of environmental protection and quality approval, and 30 percent said they did not know these standards; 63 percent cited a lack of instructions for how to incorporate these standards in their work; and unsurprisingly only 53 percent of mobile banking clients reported their agent discussed environmental protection with them.

Access to Microfinance Products and Services

Although the loan allowed Jaïda to support more than 50,000 microenterprises through the financial crisis, no associations transformed into financial institutions and therefore did not offer microenterprises new financial services and products by program end. Furthermore, the time required to make mobile banking effective was underestimated, particularly for microcredit associations and microenterprises with no prior experience with mobile banking, which explains why this activity only achieved 9 percent of its target.

Income and Sustainability

The evaluator suggested the effects of the Jaïda loan agreement may last at least 10 years, especially with integrating social and environmental standards in the credit policies of microcredit associations. In addition, the project provided the three microcredit associations representing 90 percent of the market—FONDEP, AL AsMANA, ATTAWFIQ—the institutional and financial capacity to pursue their transformation in accordance with BAM requirements.

MCC Learning

Consider readiness of institutions to react and absorb financial support that is provided for a short time frame with little advance notice. Larger, established institutions may be more effective at responding, potentially leaving out small and less established institutions.

Define the skills that should result from training and develop content to respond to that skill development.

To improve effectiveness of new products and services—such as mobile banking—build awareness for potential clients into work plan to inform realistic time frames and necessary resources to achieve expected results.

Involve expected project participants in project preparation and design to manage risk, improve efficacy, and empower potential beneficiaries.

Allow project supported entities a sufficient margin for maneuvering (interest rates, reporting, etc) to respond to evolving context. In the case of the Jaïda loan, use of grant funds to implement some of the project’s sub-activities provided flexibility, allowing the associations to define their own project needs and timelines through the financial crisis, while staying within the broad scope of the compact’s activities.

Evaluation Methods

A mobile bank serves customers on a busy street in the town of Ouaouizeght, in Azilal Province, Morocco.

The training in environmental and social standards was implemented from January 2009-Novement 2012; Jaïda distributed project funds to microcredit associations from June 2009-December 2011; and technical assistance for associations was implemented from November 2011-September 2013, resulting in an exposure period between 0-57 months.

The performance evaluation of the Financial Services Project used a primarily pre-post methodology relying on data collected between June and September 2013:

- Quantitative surveyswith 106 mobile banking clients and 106 credit agents and agency managers trained in social and environmental standards.

- Qualitative interviewswith the key actors involved in the design and implementation of the project.

2020-002-2383