Program Overview

MCC’s $449.6 million El Salvador Compact (2007-2012) funded the $67 million Productive Development Project which included the $8 million Investment Support Activity and the $3.4 million Financial Services Activity. The activities, along with the Production and Business Services Activity, aimed to increase production and employment in the Northern Zone. The activities were based on the theory that after receiving training, participants would access loans to invest in their businesses and contract paid labor, resulting in higher production and sales.

Evaluator Description

MCC commissioned Mathematica Policy Research to conduct a final performance evaluation of the Productive Development Project’s Investment Support and Financial Services Activities. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/68.

Key Findings

Loan Design and Implementation

- The Trust Fund to Support Investment in the Northern Zone (FIDENORTE) disbursed 28 loans worth $5.3 million, even though original targets were 50 loans worth $17 million.

Borrowers’ Performance

- FIDENORTE borrowers had higher average earnings than non-borrowers (accepted applicants who chose not to participate); however, loan obligations reduced expected earnings.

- 67 percent of borrowers with profitable businesses reported that they could not have achieved success without FIDENORTE.

Financial Services Design and Implementation

Financial Services Results

Access to Credit in the Region

Evaluation Questions

This final performance evaluation was designed to answer the following questions.

- 1

How was the Investment Support Activity designed and implemented - 2

What were borrowers’ levels of investment, employment, and income? - 3

How was the Financial Services Activity designed and implemented? - 4

What were the default rates of the guarantee programs? - 5

Were there potential effects of the activities on access to credit in the region?

Detailed Findings

These findings build upon the interim Investment Support Activity evaluation report results published in 2012.

Loan Design and Implementation

Produce in market

The Salvadoran accountable entity, FOMILENIO, and the Development Bank of El Salvador (BANDESAL) formed the FIDENORTE trust fund to administer loans. The original lending target for FIDENORTE was 50 approved loans worth $17 million, but by the end of the program, FIDENORTE approved 44 loans worth $7.5 million, ultimately only disbursing 28 loans worth $5.3 million. The activity fell short of its lending targets because of delays in defining the investment product, BANDESAL’s limited experience as a first-tier lender, and a complex process for loan approval.

Borrowers reported that FIDENORTE loans gave them money to invest in their businesses with a lower interest rate and a larger loan amount than they would have otherwise obtained. However, FIDENORTE failed to generate synergies with the Production and Business Services Activity (PBS). FIDENORTE set the minimum loan amount at $50,000, which effectively denied credit to a large portion of small-scale producers receiving training under PBS.

Borrowers’ Performance

Although FIDENORTE borrowers had substantively higher average earnings before interest, taxes, depreciation, and amortization than non-borrowers, their loan obligations reduced their earnings to less on average than that of non-borrowers. The majority of borrowers said their net income was lower than expected.

According to follow-up surveys, over 60 percent of borrowers had profitable businesses three years after receiving credit; 67 percent of borrowers with profitable businesses reported that they could not have achieved this success without FIDENORTE. However, around 40 percent of borrowers experienced serious setbacks with their businesses and faced high loan payments.

In follow-up surveys, 84 percent of borrowers reported difficulties paying their monthly quotas. While 15 of 28 loans had been repaid in full, 4 loans were in good standing, and 9 were in default. An analysis of loan default showed no conclusive evidence of increased risk of default correlated with business size, economic sector, or region.

Financial Services Design and Implementation

Agriculture and non-agriculture lending and total value relative to the lending target

Benefiting from strong client demand and existing processes, the PROGARA Norte guarantee fund met its target of 5,200 guaranteed loans. However, the total value of guaranteed loans of $8 million did not meet the target of $14 million. The program had overly optimistic projections for the average value of guaranteed loans.

PROGARA Norte provided guarantees to financial institutions that had no access to public guarantee funds and served a distinct risk pool of clients relative to more established banks. Therefore, it is possible that these financial institutions’ use of the fund facilitated access to credit for clients that would not have found alternate financing. However, the interaction envisioned between PROGARA Norte and PBS was limited – less than 3 percent of PBS participants received a PROGARA Norte-guaranteed loan.

SGR Norte formalized 210 guaranteed loans valued at nearly $4.5 million. Compared with other loans made without guarantees, SGR Norte loans were substantially smaller, had longer repayment periods, went disproportionately to men, and were more likely to be issued for agriculture and commerce.

Ten financial institutions in the Northern Zone received FOMILENIO-subsidized technical assistance. The assistance covered a wide range of projects, including an evaluation of internal controls, an analysis of a new rural microcredit product, improvements to information systems, and training in loan analysis, collection, and customer service.

The activity aimed to finance up to $2.6 million in crop insurance premiums for farmers in the region. Only one farmer bought a crop insurance policy and the crop insurance program was cancelled. Farmers did not fully internalize the risk of agricultural production and were not convinced that this risk merited investment in insurance.

Financial Services Results

PROGARA Norte repayment was largely successful – only 3 percent of guaranteed loans were called up. The rate of SGR Norte repayment was high, of the $4.5 million in formalized loans, $151,000 was in default. The evaluation suggests that a public partial guarantee scheme supporting agricultural and nonagricultural investments has strong demand and potential sustainability in El Salvador.

According to interviews with financial institutions that received technical assistance, three of the four financial institutions expressed satisfaction with the technical assistance, including the consultant selection process and the overall quality of consultants’ work. Two of the financial institutions also reported making substantial changes to their organizational structure or product offerings as a result of assistance, and they said these changes ultimately increased their client base and geographic coverage.

Access to Credit in the Region

The $5.3 million disbursed in FIDENORTE loans is unlikely to have increased agricultural lending in the region by a large magnitude. However, BANDESAL staff reported that its experience managing FIDENORTE played a large role in its formulation of the Salvadoran Development Bank in 2012. In addition, Garantías y Servicios staff, who managed the SGR Norte guarantee program, believed the loan guarantee program helped expand their business in the Northern Zone.

MCC Learning

The activity’s objective, target population, type of intervention, definitions, selection methodology, and expected results should be defined prior to investment.

Starting up a new financial product or service takes time and should be done as early as possible in the Compact; otherwise, existing services with a proven track record should be expanded.

Implementer capacity matters.

Overhead costs need to be considered when designing the size of financial activities.

Linkages between activities will not happen on their own

Evaluation Methods

This performance evaluation used an ex-post methodology with an exposure period of 1 to 4 years.

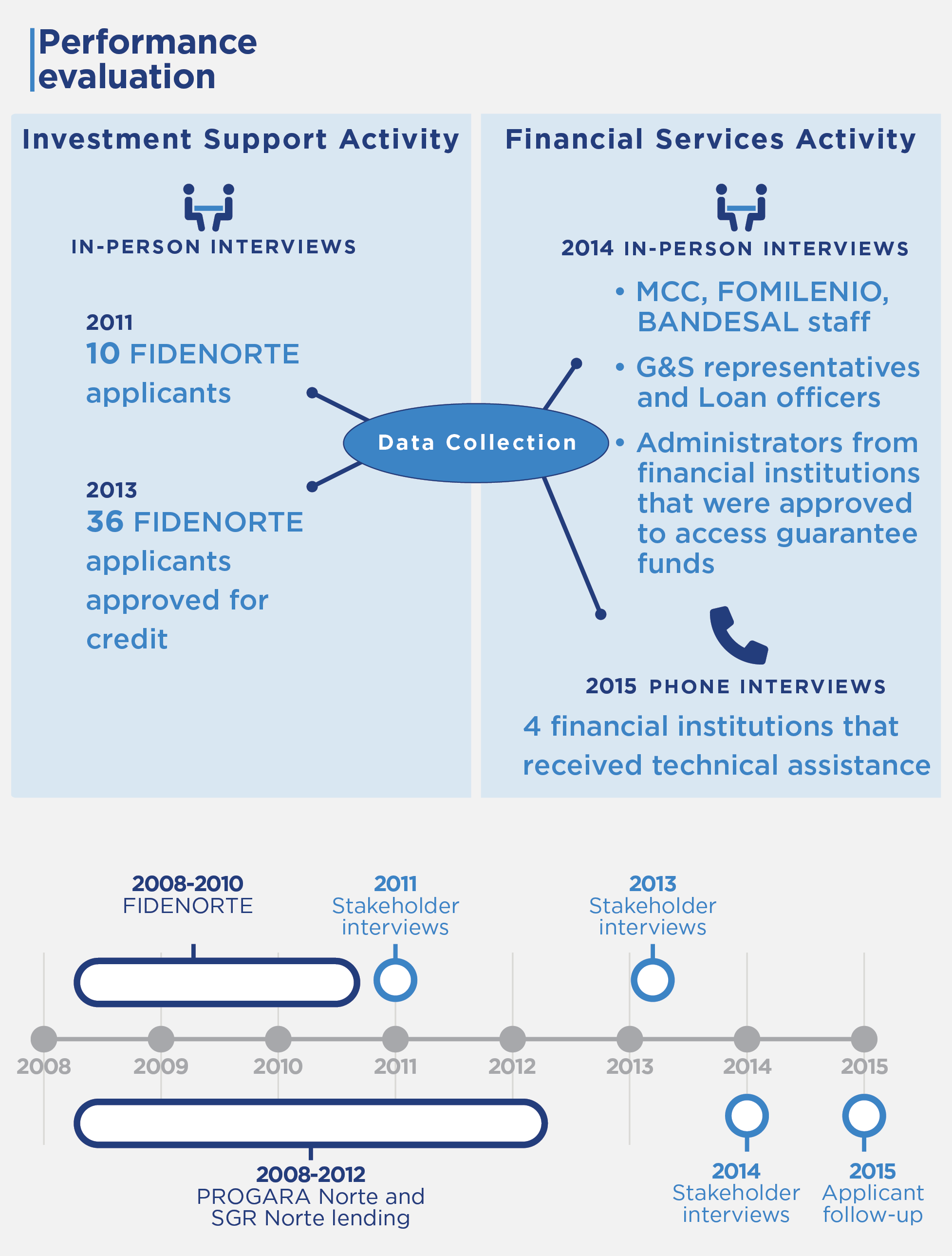

The Investment Support Activity analysis relied on interviews conducted in 2011 and 2013. In 2011 there were in-person interviews with a purposive sample of ten FIDENORTE applicants that applied for credit. This sample was selected to generate a group of applicants across a range of sectors, half of which accepted FIDENORTE credit and half of which did not accept or qualify for FIDENORTE credit. In 2013, there was an in-person follow-up interview of 36 of the 42 FIDENORTE applicants who were approved for credit.

The Financial Services Activity also used interviews carried out in 2014 and 2015. In 2014, the data collection consisted of in-person interviews with MCC and the implementers, in addition to loan officers and administrators from financial institutions that were approved to access the guarantee funds. In 2015, there were phone interviews with four financial institutions that received technical assistance in 2010 and 2011.

2022-002-2678