Program Overview

MCC’s $40.5 million Sierra Leone Threshold Program (2016–2021) focused on establishing a foundation for the effective and financially viable provision of electricity and water services in Freetown. The $11.9 million Electricity Sector Reform Project (ESRP) aimed to improve the electricity sector’s institutional and legal frameworks, planning capacity, and operational efficiency. The $7.6 million Regulatory Strengthening Project (RSP) aimed to build the capacity of the new regulator, improve sector governance and support the long-term financial sustainability of the electricity sector.

Key Findings

Coordination and Planning

- Participation in steering committee meetings increased, the sector roadmap was used for vital planning, and decision-makers received tools to monitor and manage performance.

- It is uncertain if activities will be sustained beyond the ESRP as the Ministry of Energy’s planning unit is understaffed and underfunded.

Operational Capacity and Financial Performance

- The Electricity Generation and Transmission Company (the Generation Company) improved on operational metrics including planning, data use and reporting to the regulator. The Electricity Distribution and Supply Authority (the Distribution Authority) received limited support from the ESRP.

- Neither utility generated sufficient income to fully cover debt obligations.

Regulatory and Tariff Reform

- The Electricity and Water Regulatory Commission (the Regulator) credited the RSP with a successful tariff dry run, passing regulations through Parliament and improving oversight of utilities. However, limited funding threatens the regulator’s independence.

- While the regulator achieved 90 percent of the Results-Based Financing Activity’s target payments, the Generation Company and the Distribution Authority received less than 30 percent.

Evaluation Questions

This performance evaluation was designed to answer the following questions:- 1 To what extent has coordination and planning within the electricity sector improved as a result of the ESRP?

- 2 What evidence is there that the Generation Company and Distribution Authority are improving their financial performance as a result of the ESRP?

- 3 How have the activities impacted business operations and strategic planning within the Generation Company and Distribution Authority?

- 4 How useful were the RSP’s efforts in realizing regulatory and tariff reforms in the electricity sector?

Detailed Findings

Coordination and Planning

Kingtom thermal power station and the Generation Company’s headquarters

The participatory roadmap development process was well received, and multiple respondents noted they used the roadmap in subsequent planning. However, follow up on roadmap-related action items has been low. It is unclear when permanent staff will be hired for the Ministry of Energy’s planning unit and if the power purchase agreement’s terms will be upheld.

Operational Capacity and Financial Performance

Staff members cited the Generation Company’s project-funded business plan as a key resource for improving their operational planning, including establishing units for transmission as well as planning and development. However, both units lack staff and resources, and much of the plan is awaiting implementation due to financial constraints. At the end of ESRP, the Distribution Authority received critical improvements, including a customer census, geographic information systems mapping and a commercial loss pilot, but their usability and sustainability have not yet been tested. For both utilities, trainings that aimed to improve technical and managerial capacity were generally well received, but staff turnover hampered their effectiveness. COVID-19 further impacted training at the Generation Company.

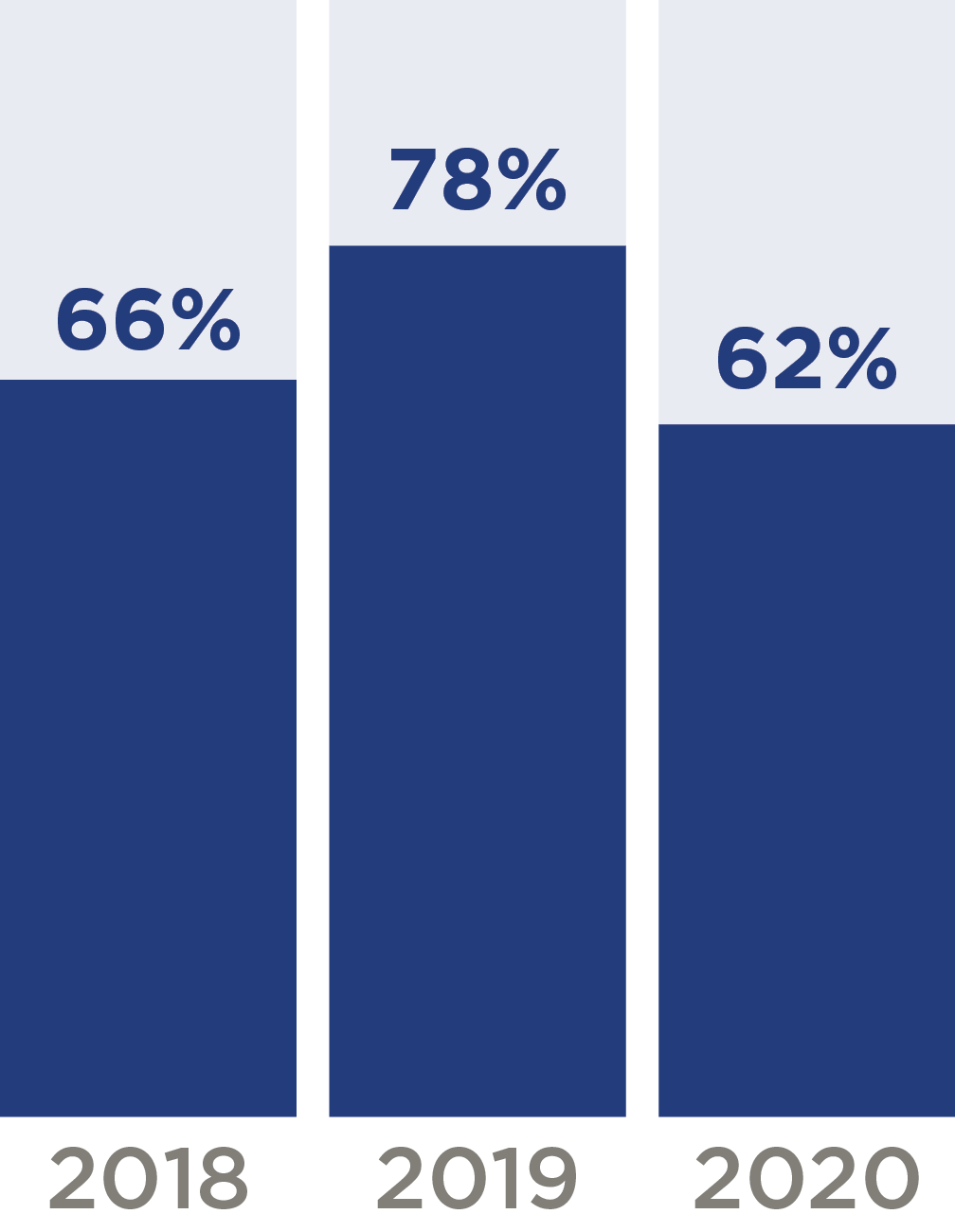

The Generation Company’s efficiency ratio of collection-to-billed amount.

We can make it [the Generation Company] better in terms of planning and investment. However, the institution is on a lifeline. If nothing is done to promote cash collection [at the Distribution Authority], what [the Generation Company] has done will not be sustainable for the next five years.–Generation Company staff

Regulatory and Tariff Reform

The Regulator’s mission, vision and mandate posted in their office.

The Results-Based Financing Activity increased the regulator’s political legitimacy by helping pass formal regulations through Parliament. The utilities underperformed on most of their results-based financing targets. The Distribution Authority’s poor performance was attributed to limited data capacity; delays in procurement for needed equipment; and COVID-19, which inhibited necessary customer site visits that were critical to loss reduction targets. At the Generation Company, COVID-19 led to a shortened training for results-based financing targets, which was completed late in the RSP and without the needed equipment.

MCC Learning

- To better align with MCC’s focus on results, threshold programs need to specify clear, credible, and measurable targeted results (and/or program logics) that are linked to evidence-based timelines for when results can be expected

- The design of results based financing initiatives needs to consider how unexpected programmatic changes could reduce achievement on key performance indicators and explore strategies to mitigate negative impacts on achievement as needed.

Evaluation Methods

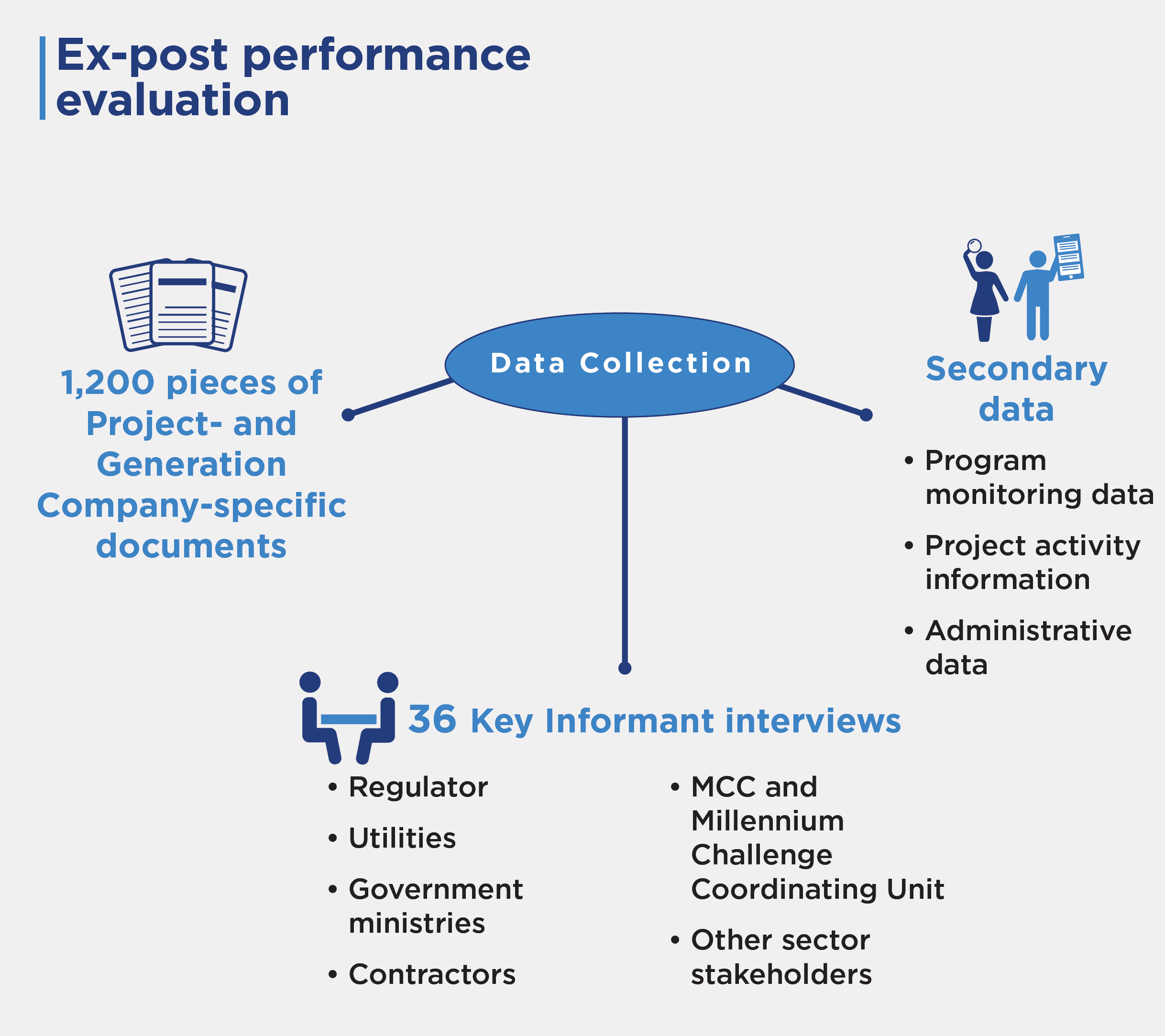

- A document review that included 1,200 pieces of project- and EGTC-specific documents.

- Secondary data, including program monitoring data collected through the Sierra Leone Threshold Program Monitoring and Evaluation Plan, information available from project activities, and other administrative data.

- Key informant interviews with 36 energy and regulatory sector stakeholders that were conducted remotely using semi-structured, tailored tools. Respondents were purposively selected from the following stakeholder groups, with the number of corresponding respondents in parentheses: regulator (5), utilities (10), government ministries (2), contractors (7), MCC and Millennium Challenge Coordinating Unit (11), and other sector stakeholders (1).

2021-002-2605