Program Overview

MCC’s $391 million Benin Power Compact (2017-2023) supported access to electricity through the $31 million Off-Grid Electricity Access Project. The project provided financing for off-grid electrification through the Off-Grid Clean Energy Facility, together with funding for policy reform and institutional strengthening in the off-grid sector. Project activities aimed to increase the hours of operations for businesses and institutions, reduce reliance on costlier energy sources, reduce losses of products and perishable goods, and improve electricity users’ productivity.

Download the French translated evaluation brief.

Key Findings

Ambitious Targets in a Nascent Sector

- By compact end, the Off-Grid Electricity Access Project facilitated over 36,000 new connections, short of the 66,000 target.

- The compact timeline was insufficient to both fully implement the newly-developed regulatory framework and allow the envisaged Off-Grid Clean Energy Facility investments to be made.

- The mini-grid investments were most affected by a regulatory approval process that took up to two years.

Challenges in Co-Financing

- The Facility’s original performance-based grants approach required the private sector to bear a large portion of the initial investment cost.

- Challenges in implementation necessitated a revision of grant milestones to ensure funding disbursement by compact close.

Regulatory Reform and Investor Interest

- The new Regulatory Framework was crucial in ensuring private interest and investment in the sector.

- The Facility leveraged over $30 million in private sector funding.

- The sector faces challenges for expansion including market saturation, reduced viable mini-grid locations, and rising prices.

Evaluation Questions

This interim performance evaluation was designed to answer the following questions that will inform the final evaluation:

- 1

Was the Off-Grid Clean Energy Facility designed and implemented in a way to encourage high-quality projects? - 2

To what extent has the regulatory framework for off-grid energy been implemented? - 3

To what extent did the project encourage additional investment in the sector in Benin?

Detailed Findings

These findings build upon the baseline evaluation report published in 2021.

Ambitious Targets in a Nascent Sector

By March 2023, the Off-Grid Clean Energy Facility had facilitated electricity connections for over 36,000 residences, businesses, and facilities, primarily through solar home systems. However, these achievements fall far short of the 66,000 connections targeted with the gap primarily attributed to underperformance of mini-grid projects. By compact close, 3 out of 7 agreements with mini-grid developers had been cancelled, and these cancellations reduced the number of planned mini-grids by a half.

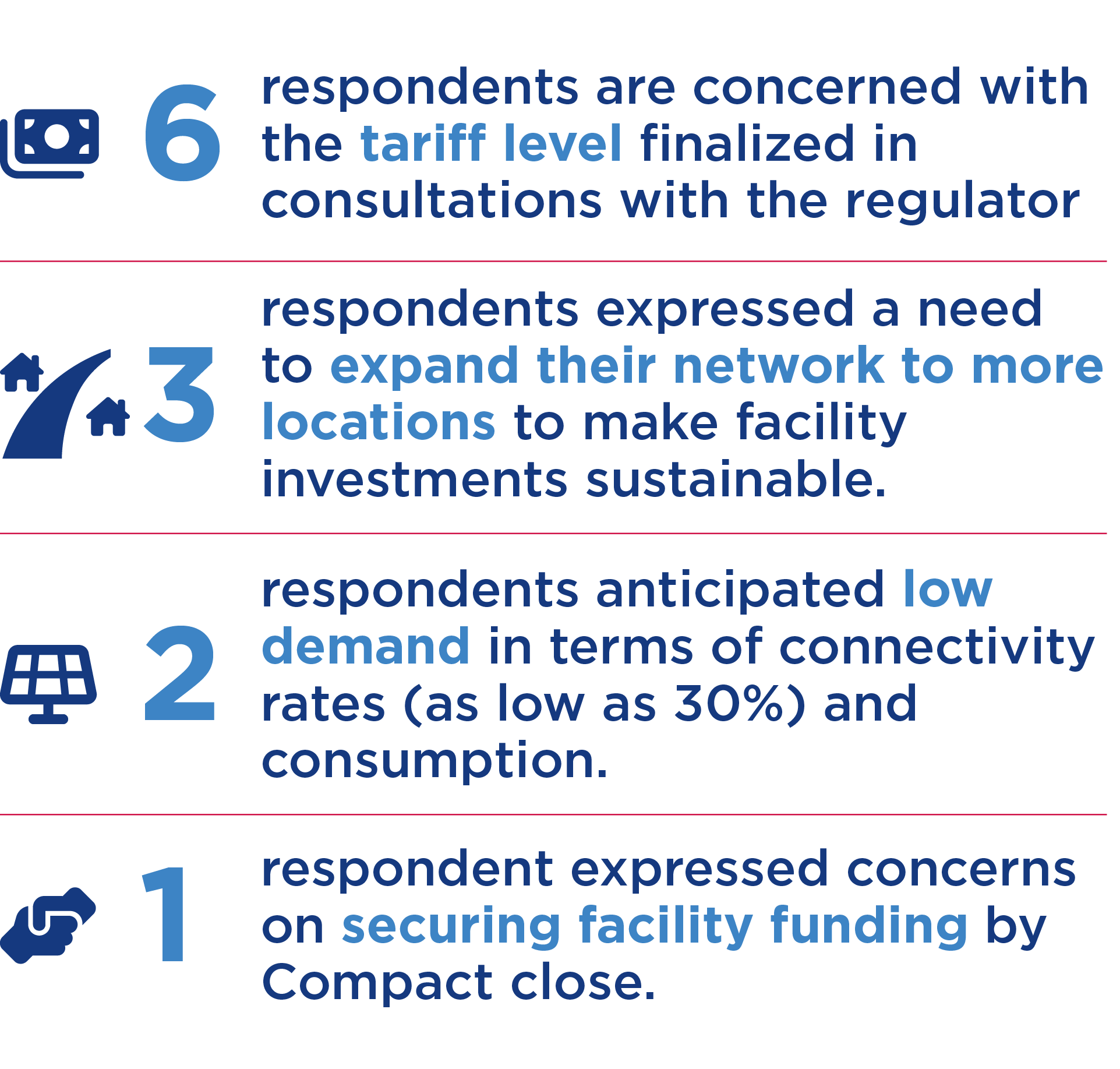

The project’s timeframe, which included the establishment of a new Regulatory Framework in 2018, was too ambitious. There was insufficient time for the institutionalization of the framework prior to the implementation of mini-grid projects. Approved Facility proposals did not conform with the government’s licensing requirements and required revisions in site selection, tariff projections, and technical approach, a process that took up to two years. The timeframe strained investor confidence and increased costs, particularly as COVID-19 and the war in Ukraine drove up the price of renewables worldwide. Developers that were able to move forward expressed common concerns about sustainability, including over the inability to ensure cost-reflective tariffs and adequate customer demand.

Challenges in Co-Financing

The Facility co-financed off-grid electrification efforts. Under a performance-based grants design, all up-front risk was originally placed on the private sector including start-up costs, staffing, site selection and customer identification, securing regulatory approvals, and purchasing of equipment. Challenges with site selection and customer identification, delays in regulatory approvals, and market disruptions meant that many developers invested years in the project prior to receiving funds from the Facility.

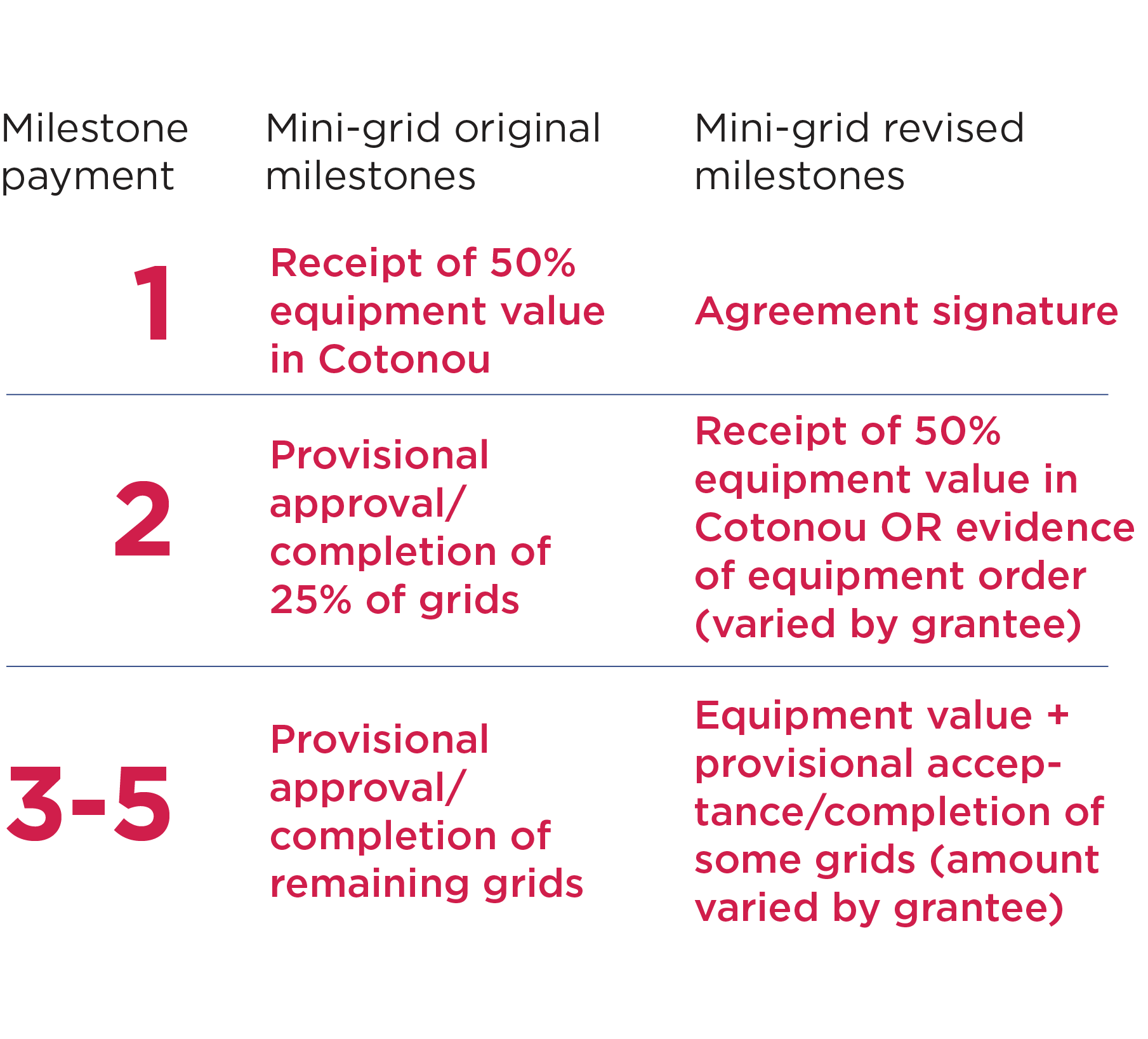

Milestone revisions were later made to better distribute risk and ensure full disbursement of funding prior to compact close. For some mini-grids, full disbursement of funding would occur prior to work completion, and only 40 percent of mini-grids were anticipated to be completed by compact close in mid-2023.

Milestone adjustments were slow to process, often leaving developers waiting for several months to assess the viability of their projects. Unclear and delayed communication was a core frustration for many developers, and one respondent noted that if milestones had initially been structured differently, fewer developers would have left the project.

Regulatory Reform and Investor Interest

The project stimulated investor interest and, following project inception, additional funding has become available (in addition to $30 million in private sector funding secured by the Facility). Other investors like the European Investment Bank have committed over $10 million and partnered with Facility developers to increase off-grid renewable energy access in Benin. Finally, non-Facility developers have entered the market and purchased concession agreements for canceled Facility projects. The Off-Grid Energy Access Project played a critical role in stabilizing the operating environment through the establishment of the Regulatory Framework. The Framework and the Facility’s subsidization increased investor confidence and brought several developers to Benin for the first time.

However, the sector faces challenges for expansion including market saturation, reduction in the number of viable mini-grid locations, and rising prices. Future growth in the sector will require a renewed commitment to off-grid solutions and careful planning for grid expansion and off-grid integration in the future.

MCC Learning

Implementing a grant facility in a nascent sector with a new regulatory framework is ambitious for MCC’s five-year timeline. During design, MCC should propose targets which can realistically be achieved during the life of a compact.

Consider grantee financial capacity and targeted business models when structuring grants.

Consider implementation timelines when designing and timing evaluation work.

Evaluation Methods

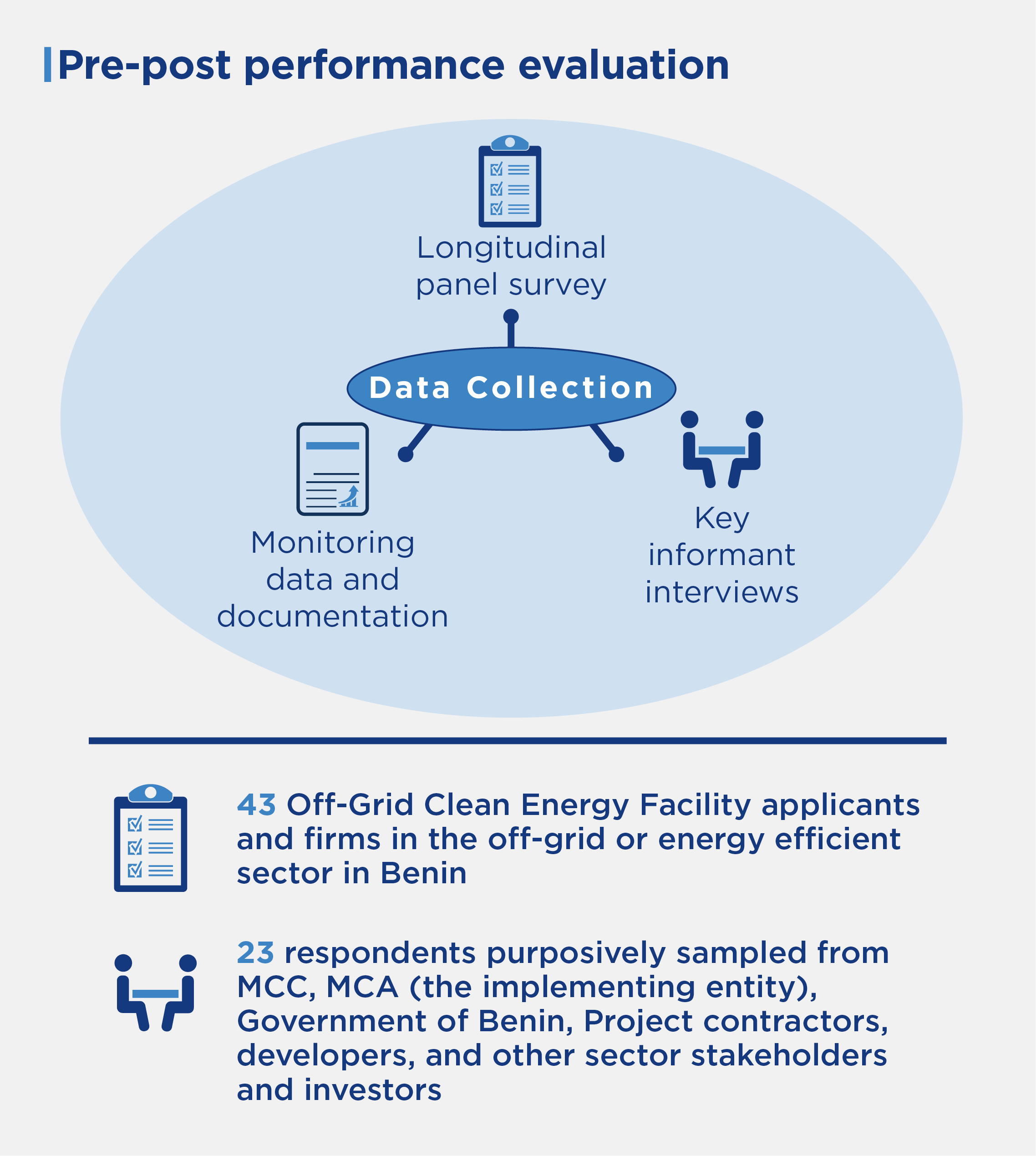

This interim evaluation is a pre-post performance evaluation. It makes use of program monitoring data and documentation, as well as primary data collected by the evaluation team. Primary data was collected from March-May 2023 and includes:

- A longitudinal panel survey of 53 Off-Grid Clean Energy Facility applicants and firms in the off-grid or energy efficient sector in Benin. This interim survey was a follow-up from a survey conducted by the evaluation in 2020.

- Key Informant interviews with 23 respondents purposively sampled from MCC, MCA (the implementing entity), Government of Benin, Project contractors, developers, and other sector stakeholders and investors.

The evaluator’s analysis triangulated information across data sources to identify emergent trends and aggregate data around common themes and findings.

Next Steps

A final study covering additional evaluation questions, including the project’s impact on beneficiaries, is underway and results will be available in 2026.

2024-002-2909