MCC

The new MIIA-Africa platform is designed to spur and attract investments in Africa for bankable infrastructure deals with measurable social and economic impacts. To do so, MIIA-Africa will support project preparation, tackling a major constraint to unlocking the available pools of capital for the benefit of infrastructure development in Africa. Investments through MIIA-Africa will cover projects across sectors such as water and sanitation, agriculture, health, education, transportation, power, and telecommunications.

Design work for MIIA-Africa has now been completed and MCC and Africa50 are actively soliciting infrastructure projects that have the potential to become part of the project pipeline.

The MIIA team will deepen its engagement with the private sector by issuing requests for information on potential MIIA projects.

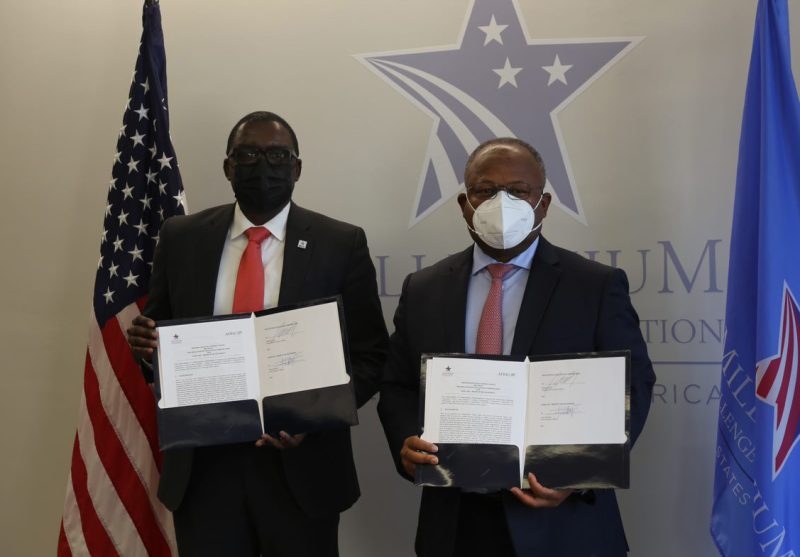

“MCC is pleased to advance the MIIA-Africa collaboration, leveraging the agency’s track record in financing and delivering impactful infrastructure projects in Africa, all well-aligned with the goals of the Build Back Better World initiative” said MCC Acting CEO Mahmoud Bah. “Africa50’s reach and impact on the continent ensures this collaborative effort has the potential to identify projects with substantial economic opportunities on the continent.”

Africa50 CEO Alain Ebobissé added “Africa50 is very pleased to reinforce its existing partnership with MCC. This important new milestone in the MIIA-Africa programme will help increase the pipeline of bankable projects and attract further capital into African infrastructure. Africa50 will contribute its strong expertise in project development and finance to accelerate the delivery of such projects and support the continent’s sustainable economic growth.”

MIIA-Africa is one of MCC’s innovative finance tools to mobilize private capital to maximize the impact of highly developmental projects that spur sustainable and inclusive economic growth and reduce poverty. As an independent U.S. government agency, MCC works around the world with the best-governed developing countries, providing grant funding to unlock economic potential. About two-thirds of the agency’s portfolio is in Africa.

Africa50 is an infrastructure investment platform that contributes to Africa’s growth by developing and investing in bankable infrastructure projects, catalyzing public sector capital, and mobilizing private sector funding, with differentiated financial returns and impact. Africa50 currently has 31 shareholders, comprised of 28 African countries, the African Development Bank, the Central Bank of West African States (BCEAO), and Bank Al-Maghrib.

Learn more about MCC at www.mcc.gov.

Learn more about Africa50 at www.africa50.com.