MCC's country scorecards, which use objective, third-party indicators, are an example of the agency's evidenced-based approach. The scorecards hold us accountable for spending taxpayer dollars responsibly and hold our partner countries accountable for living up to their commitments.

As part of its commitment to using the best and most rigorous data, MCC regularly reviews the indicators on the MCC scorecard to ensure that we are using the highest quality data and methodologies available. As new datasets become available and our understanding of the links between governance and poverty reduction improve, regular reviews of our indicators are essential. MCC focuses on indicators with broad country coverage, regular updates, and publicly available data that are produced by third-party institutions.

Country Selection and the MCC Effect

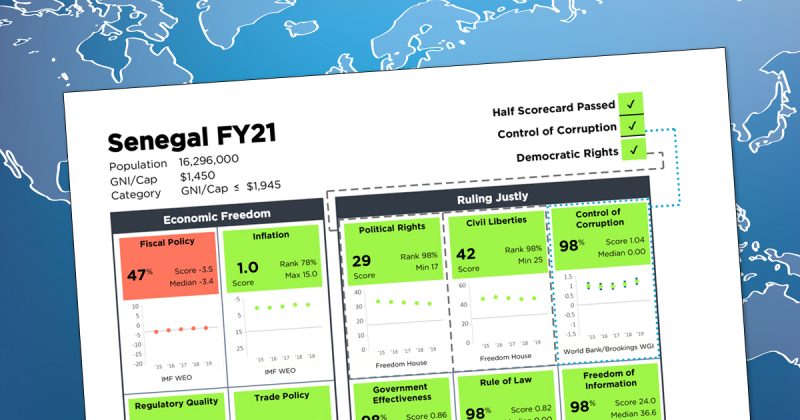

Evidence-based selection of partner countries is a cornerstone of MCC’s development model. Only those low- or lower-middle-income countries that meet MCC’s strict selection criteria can be selected as eligible to receive MCC grants. MCC’s Board assesses a country’s commitment to good governance using 20 different policy indicators, which are compiled on the MCC scorecard. The scorecard draws data from independent, third-party institutions to transparently and objectively measure a country’s commitment to democratic governance, social investment, and economic freedom. These are areas MCC sees as critical to creating an enabling environment for sustained, inclusive economic growth.The incentivizing aspect of MCC’s selection criteria is often referred to as the “the MCC Effect.” That is, countries have and continue to use the MCC scorecard as a roadmap for building institutional capacity, often before MCC invests a single dollar. In doing so, countries make critical reforms to boost policy performance in hopes of qualifying for a compact program. MCC investments couple significant grant funding for large infrastructure with key policy and institutional reforms that aim to reduce poverty through economic growth. Furthermore, countries that receive MCC investments are historically more attractive to private investors because those countries have independently pursued government and business policies vital to sustained economic growth.

Access to Credit and Land Rights & Access: Critical Indicators for Equity and Growth

MCC is revising these two scorecard indicators to incorporate newly published datasets on financial inclusion and property rights, expanding their coverage to ensure that the indicators are looking beyond the presence of formal legal frameworks for credit registries and narrowly defined land transfer laws. These more inclusive indicators of a country’s business climate now also measure the ability of an entire population to own property or access credit, not just the business climate for the elites.The Access to Credit indicator will now measure informal sector credit, credit access, credit usage, rural populations, and financial inclusion. The indicator continues to encourage support for the formal economy while significantly expanding to promote financial access for traditionally marginalized communities through traditional and technological financial instruments (such as susus and mobile money) that better fit the credit needs of rural and poor populations. This is essential because improving credit access for small businesses and poor populations can have a substantial impact on agricultural development, poverty reduction, and broad-based economic growth. Starting in FY22, the updated Access to Credit indicator includes data on Financial Institution Access from the IMF’s Financial Development Index database and data on account ownership from the World Bank’s Global Findex Database.

The Land Rights and Access indicator will now measure a wider range of property rights for a broader range of individuals and businesses. In addition to retaining measures of land tenure and equitable land management from the International Fund for Agricultural Development (IFAD), this indicator expands the definition of property rights to include inheritance laws, non-land property, and restrictions on property rights from customary law and social norms. Additionally, this revised indicator expands the population under consideration to include small businesses, rural businesses, and individuals. This is crucial because rural and small businesses can often face greater restrictions to conducting business and accessing finance. Promoting inclusive property rights is essential to MCC’s mission because it has been shown to have positive impacts on women’s economic empowerment, broad-based economic growth, and poverty reduction. Starting in FY22, the updated Land Rights and Access indicator combines data from the Varieties of Democracy Institute on property rights with IFAD’s Rural Sector Performance Assessment.