Program Overview

MCC’s $295.7 million Namibia Compact (2009-2014) funded the $138.6 million Education Project, which included the $3.4 million National Training Fund (NTF) Sub-Activity. The program aimed to address the skills gap in Namibia’s labor force by establishing a sustainable source of funding for high-priority vocational education and skills training, thereby better matching workers to the needs of the economy and increasing employment, earnings, and income.Evaluator Description

MCC commissioned Mathematica Policy Research to conduct an independent interim performance evaluation of the National Training Fund Sub-Activity under the Namibia Education Project. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/200.

Key Findings

Operationalization of the National Training Fund (NTF)

- The NTF was formally established in 2008, but additional legislation was required to mandate the Vocational Education and Training levy so the NTF could be fully operationalized.

Registering Employers and Collecting the Levy Funds

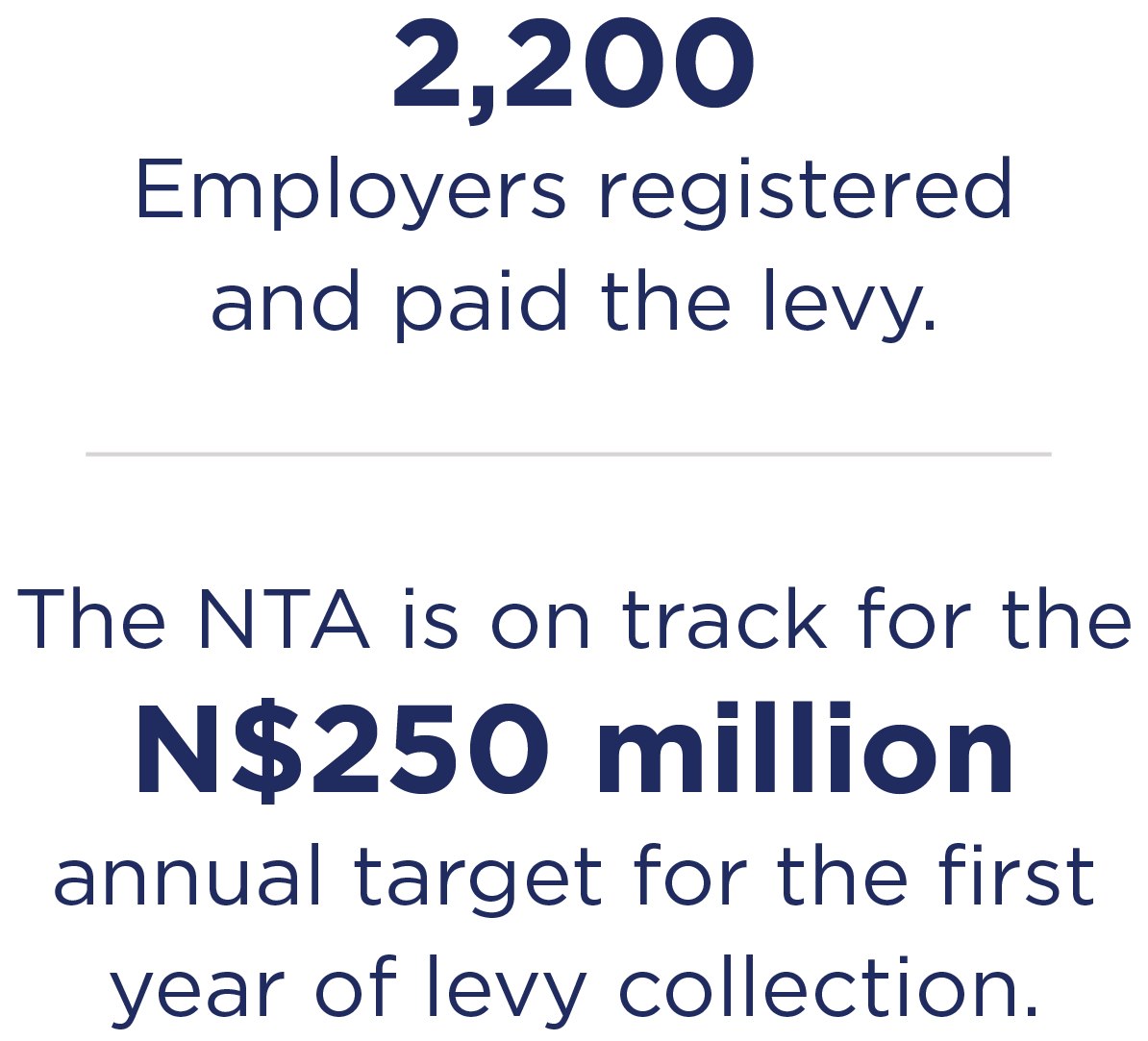

- Early signs of employer registration and levy collection are encouraging. At the time of data collection, 2,200 employers had registered and paid the levy and the Namibia Training Authority (NTA) is expected to meet the annual target of N$250 million (approximately $20.3 million USD) for the first year of levy collection.

- Effective enforcement of registration and accurate levy payment are possible concerns for the NTA.

Distributing Levy Funds

- Approximately one-half of the registered land parcel certificates were not delivered by the end of the compact.

Utilizing Levy Funds

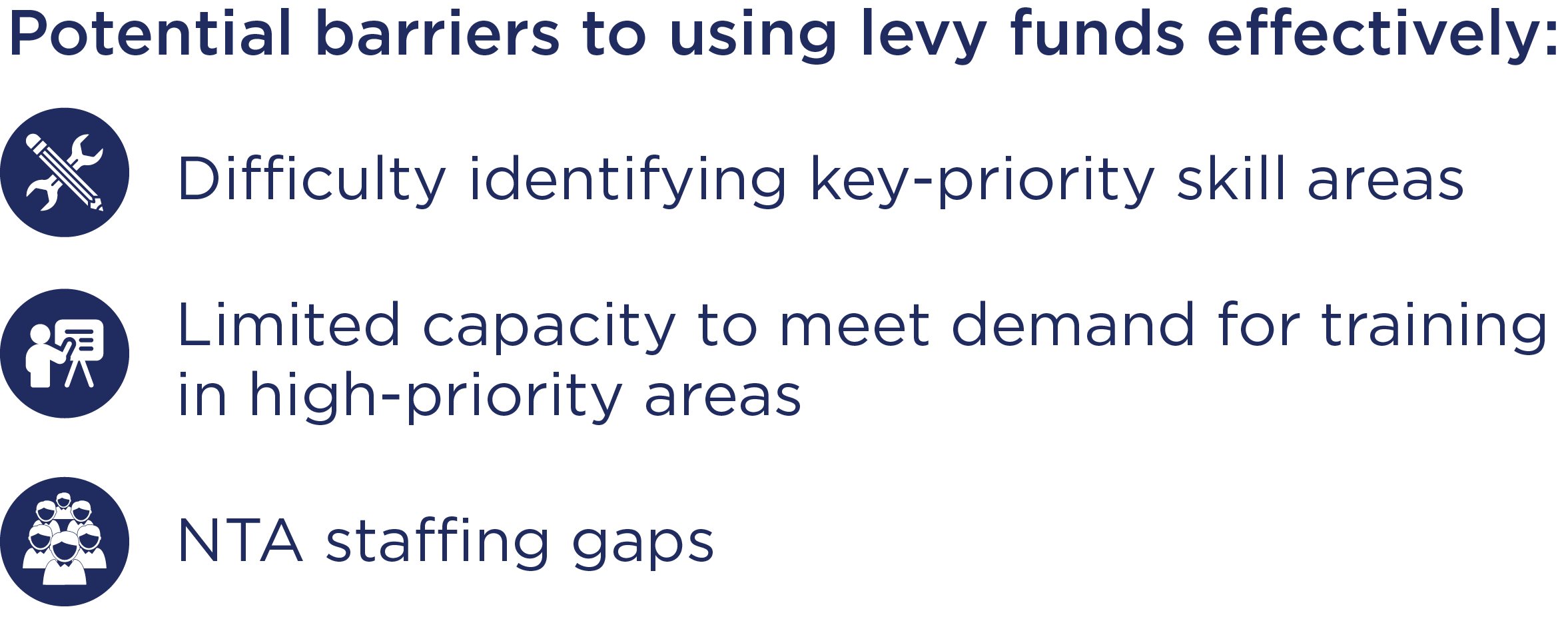

- The NTF may face some barriers in using levy funds effectively, including difficulties in identifying key-priority skill areas, limited capacity to meet the demand for training in these high-priority areas, and NTA staffing gaps.

Evaluation Questions

This interim performance evaluation was designed to answer the following questions that will inform the final evaluation:- 1 Was the establishment of the NTF levy implemented as planned?

- 2 How is the levy operating in practice compared to the specifications outlined in the regulatory framework?

Detailed Findings

Operationalization of the National Training Fund (NTF)

Trainees in the vocational education and training.

Compact-funded consultants led the operationalization of the NTF, working closely with a small team from the Namibia Training Authority. The working relationship between the consultants and NTA staff was strong, with responsibilities clearly divided. This enabled the two groups to work together effectively to mobilize the NTF Council, a body with broad stakeholder representation, designed to advise the NTA on the NTF. Furthermore, the consultants and the Namibia Training Authority successfully pilot-tested the vocational training levy with a small number of employers. This pilot provided useful insights about the functioning of the system before it was fully rolled out.

Registering Employers and Collecting the Levy Funds

Distributing Levy Funds

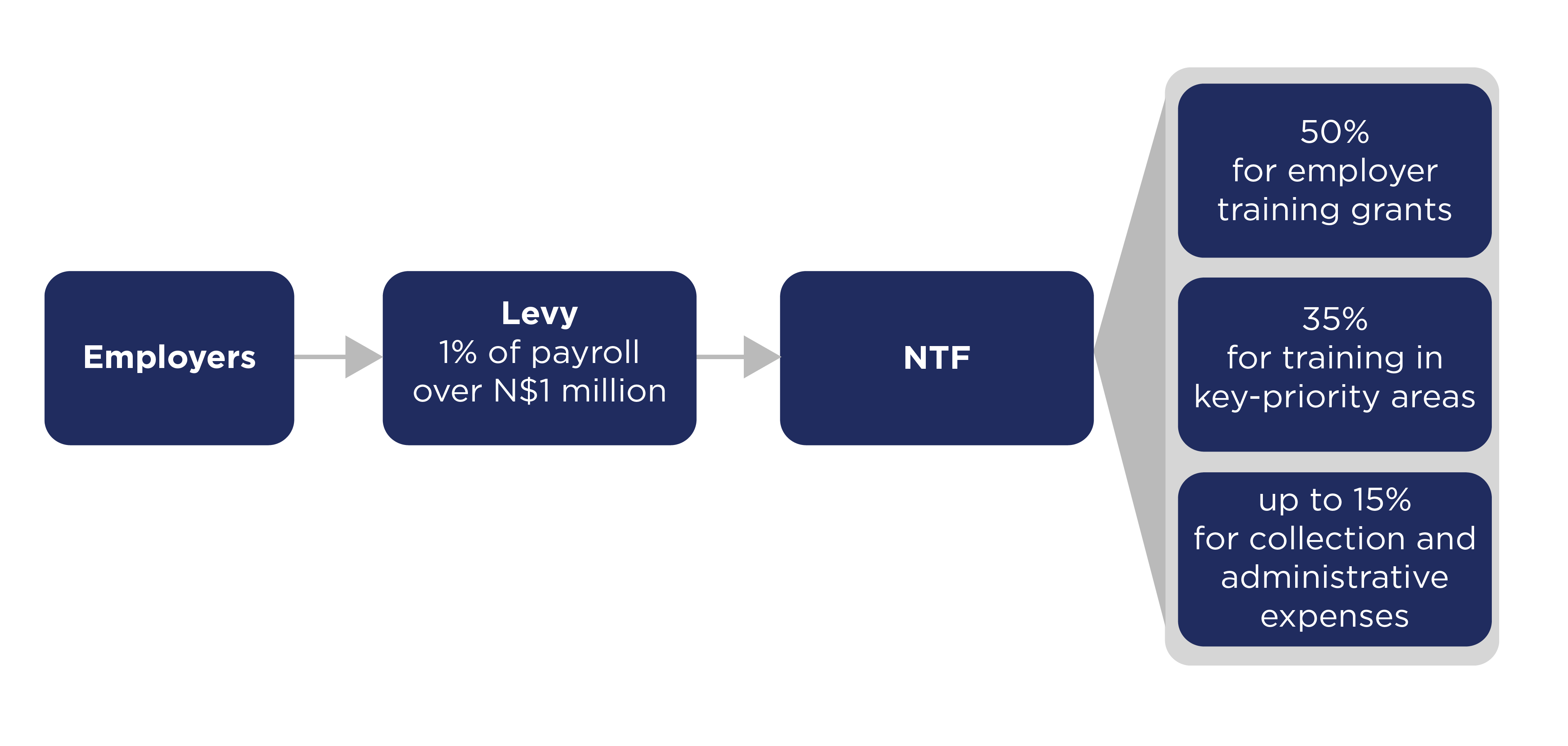

Although an important aspect of the levy system, the NTF has not transitioned to a fully operational system for distributing levy funds. As stated in the levy regulations, 50 percent of the levy funds will be allocated for employer-sponsored training grants to be reimbursed to the employers who paid the levy. However, at the time of data collection, the guidelines were still not clear on what kind of employer-provided training would be eligible. In addition, the system for submitting the request and evidence that training was conducted was not fully functioning. Therefore, although reimbursement for employer-sponsored training was expected to begin in April 2015, some work still remained to operationalize the system.

Utilizing Levy Funds

MCC Learning

- The experience of “learning by doing” should help the Namibia Training Authority manage the NTF post-compact. The Namibia Training Authority received valuable preparation for its management of the NTF by managing a large portion of the related Vocational Training Grant Fund Sub-Activity. Although this opportunity does not guarantee the NTF will be successful, it does make it more likely that the process of awarding and managing grants will operate smoothly and effectively under the NTF.

- Key policy decisions that affect sustainability should be made before MCC compacts end. Important policy decisions, such as processes for identifying priority skills areas and what constitutes vocational training, were still to be determined at the end of the Namibia Compact.

Evaluation Methods

Dishes prepared by students of the NTF Sub-Activity.

Data collection occurred in October and November 2014, so the exposure period ranged between one to seven months after the Compact ended. Data collection took place shortly after the NTF levy collection system was established in April 2014 and six months before levy funds were scheduled to begin being dispersed in April 2015. As a result, this evaluation focused on outputs, intermediate outcomes, and initial perceptions about longer-term effects.

Next Steps

A second round of qualitative data collection was conducted in 2015 and focused on the longer-term evolution of the NTF after the compact ended, including assessing whether the potential barriers in using levy funds have effectively been addressed. Results are expected to be available in 2017.2021-002-2516